UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant ☒ | Filed by a Party other than the Registrant ☐ |

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

TELKONET, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if

other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☒ | No fee required |

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

TELKONET, INC.

20800 Swenson Drive

Suite 175

Waukesha, WI 53186

414-302-2299

April 12, 2022

Dear Stockholder:

You are cordially invited to attend the 2022 Annual Meeting of Stockholders of Telkonet, Inc. (the “Company”) to be held on May 26, 2022 at 1:00 p.m., local time, at the offices of Telkonet, Inc., 20800 Swenson Dr., Suite 175, Waukesha, WI 53186.

The accompanying Notice of Annual Meeting of Stockholders outlines the matters to be brought forth at the meeting, and the accompanying proxy statement discusses these matters in greater detail. Please read both carefully.

Whether or not you plan to attend the meeting, we urge you to complete, date and sign the enclosed proxy card and return it at your earliest convenience. No postage need be affixed if you use the enclosed envelope and it is mailed in the United States. You may also vote by telephone or via the Internet. If you have any questions or need assistance in completing the proxy card or voting by telephone or via the Internet, please contact Investor Relations at ir@telkonet.com or call 414-302-2299.

Only holders of record of our common stock, par value $0.001 per share, our Series A Preferred Stock, par value $0.001 per share, and our Series B Preferred Stock, par value $0.001 per share, at the close of business on March 29, 2022 are entitled to notice of, and to vote at, the meeting or any adjournment or postponement thereof.

Our proxy statement and the proxy card are enclosed along with our Annual Report on Form 10-K for the fiscal year ended December 31, 2021, which is being provided as our Annual Report to Stockholders. These materials are also available on the following website at http://www.proxyvote.com.

YOUR VOTE IS IMPORTANT.

PLEASE SIGN, DATE AND RETURN THE ENCLOSED PROXY CARD

OR VOTE BY TELEPHONE OR VIA THE INTERNET

IMMEDIATELY, WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING.

| Sincerely yours, | |

| /s/ Piercarlo Gramaglia | |

| Piercarlo Gramaglia | |

| Chief Executive Officer |

| 1 |

TELKONET, INC.

20800 Swenson Drive

Suite 175

Waukesha, WI 53186

414-302-2299

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

April 12, 2022

Notice is hereby given that the Annual Meeting of Stockholders (the “Meeting”) of Telkonet, Inc., a Utah corporation (the “Company”), will be held on May 26, 2022 at 1:00 p.m., local time, at the offices of Telkonet, Inc., 20800 Swenson Dr., Suite 175, Waukesha, WI 53186 for the following purposes:

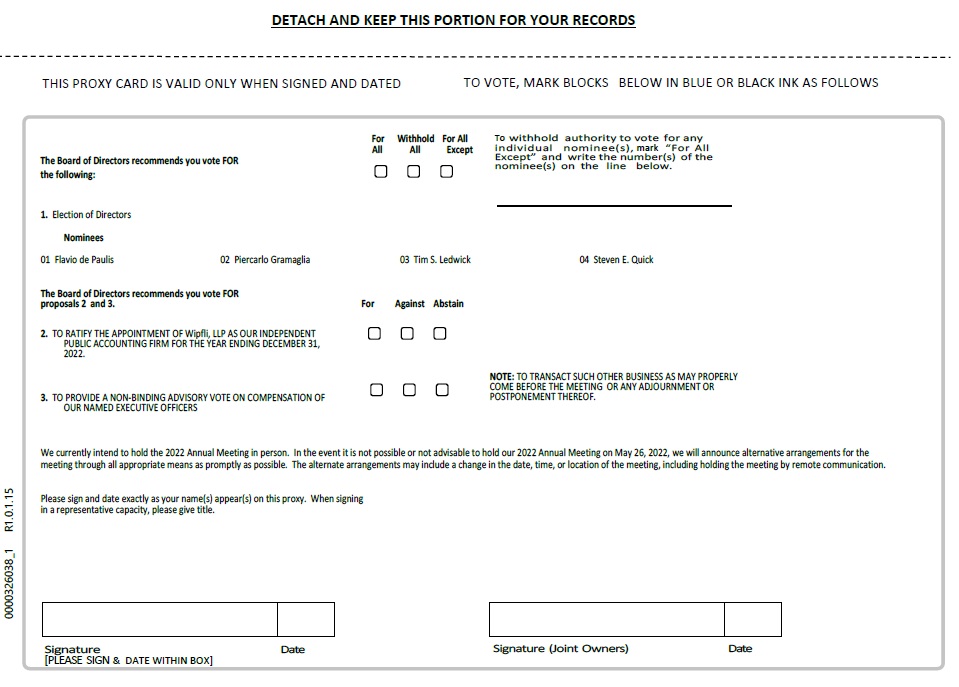

| 1. | To elect four (4) directors to the Company’s Board of Directors, each to serve until the next Annual Meeting of Stockholders and until his successor has been elected and qualified, or until his earlier death, resignation, disqualification, or removal; | |

| 2. | To ratify the appointment of Wipfli LLP as our independent registered public accounting firm for the year ending December 31, 2022; | |

|

3. 4. |

To provide a non-binding advisory approval of the compensation of our named executive officers; and To transact such other business as may properly come before the Meeting. |

Only holders of record of the Company’s common stock, par value $0.001 per share, the Company’s Series A Preferred Stock, par value $0.001 per share, and the Company’s Series B Preferred Stock, par value $0.001 per share, at the close of business on March 29, 2022, the record date, are entitled to notice of and to vote at the Meeting or any adjournment or postponement thereof.

Unless you attend the Meeting and vote your shares as discussed below, your shares will not be voted with respect to the election of directors and the non-binding advisory approval of the compensation of our named executive officers if you hold your shares in street name and have not provided instructions to your broker, bank, or other nominee. We strongly encourage you to submit your voting instruction card and exercise your right to vote as a stockholder.

Your vote is important. Even if you plan to attend the Meeting in person, the Company requests that you sign and return the enclosed proxy card, or vote by telephone or over the Internet as instructed in these materials, as promptly as possible to ensure that your shares will be represented at the Meeting if you are unable to attend. If you sign, date and mail your proxy card without indicating how you wish to vote, your proxy will be counted as a vote “FOR” each of the nominees for director, “FOR” the ratification of Wipfli LLP as our independent registered public accounting firm for the year ending December 31, 2022, “FOR” the non-binding advisory approval of the compensation of our named executive officers, and in the discretion of the proxies on any other matter which may properly come before the Meeting. If you do attend the Meeting and wish to vote in person, you may withdraw your proxy and vote in person. Please note, however, that if your shares are held of record by a broker, bank, or other nominee and you wish to vote at the Meeting, you must obtain from the record holder a proxy issued in your name.

| By order of the Board of Directors, | |

| /s/ Richard E. Mushrush | |

| Richard E. Mushrush | |

| Secretary |

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” EACH OF THE NOMINEES FOR DIRECTOR LISTED IN PROPOSAL 1, AND “FOR” PROPOSALS 2, AND 3.

YOU CAN VOTE IN ONE OF FOUR WAYS:

| (1) | Visit the website noted on your proxy card to vote via the Internet; |

| (2) | Vote by telephone at the number noted on your proxy card; |

| (3) | Sign, date and return your proxy card in the enclosed envelope to vote by mail; OR | |

| (4) | Attend the Meeting and vote in person. |

| 2 |

TELKONET, INC.

20800 Swenson Drive

Suite 175

Waukesha, WI 53186

414-302-2299

PROXY STATEMENT

This proxy statement contains information related to the Annual Meeting of Stockholders (the “Meeting”) of Telkonet, Inc., a Utah corporation, to be held on May 26, 2022 at 1:00 p.m., local time, at the offices of Telkonet, Inc., 20800 Swenson Dr. Suite 175, Waukesha, WI 53186, and at any postponements or adjournments thereof. In this proxy statement, “Telkonet”, the “Company”, “we”, “us” and “our” refer to Telkonet, Inc.

Important Notice Regarding the Availability of Proxy Materials for

the Annual Meeting of Stockholders to Be Held on May 26, 2022.

This proxy statement and accompanying notice, proxy card and Annual Report on Form 10-K for the fiscal year ended December 31, 2021, are also available on the following website at http://www.proxyvote.com.

VOTING AT THE ANNUAL MEETING

Revocability of Proxies

Any proxy given pursuant to this solicitation may be revoked by the person giving it at any time before it is voted. Attendance at the Meeting will not, in and of itself, revoke a proxy. Proxies may be revoked by:

| ● | Filing with the Secretary of Telkonet, at or before the taking of the vote at the Meeting, a written notice of revocation dated later than the proxy; | |

| ● | Voting again at a later date (but prior to the Meeting) on the Internet or by telephone; | |

| ● | Executing a later dated proxy relating to the same shares of capital stock and delivering it to the Secretary of Telkonet before the taking of the vote at the Meeting; or | |

| ● | Attending the Meeting and voting in person. |

Any written revocation or subsequent proxy should be sent so as to be delivered to Telkonet, Inc., 20800 Swenson Drive, Suite 175, Waukesha, WI 53186, Attention: Corporate Secretary, or hand delivered to the Secretary of Telkonet or his representative at or before the taking of the vote at the Meeting.

If the Meeting is postponed or adjourned, proxies given pursuant to this solicitation will be utilized at any subsequent reconvening of the Meeting, except for any proxies that previously have been revoked or withdrawn effectively, and notwithstanding that proxies may have been effectively voted on the same or any other matter previously.

| 3 |

Voting Rights

Only holders of record of our common stock, par value $0.001 per share (“common stock”), holders of record of our Series A Preferred Stock, par value $0.001 per share (“Series A Preferred Stock”), and holders of record of our Series B Preferred Stock, par value $0.001 per share (“Series B Preferred Stock”) at the close of business on March 29, 2022, the record date (the “Record Date”), are entitled to notice of and to vote at the Meeting, and at any postponements or adjournments thereof. Holders of our Series A Preferred Stock and holders of our Series B Preferred Stock will each vote on an as-converted basis together with holders of our common stock as a single class in connection with each of the proposals in this proxy statement. Each share of common stock is entitled to one vote on all matters to be voted upon at the Meeting; each share of Series A Preferred Stock is entitled to 13,774 votes on all matters to be voted upon at the Meeting; and each share of Series B Preferred Stock is entitled to 38,461 votes on all matters to be voted on at the Meeting. At least a majority of our shares outstanding on the Record Date and entitled to vote (counting our Series A Preferred Stock and Series B Preferred Stock each on an as-converted basis, representing an aggregate of 4,548,162 shares of common stock for such purposes) must be represented at the Meeting, either in person or by proxy, in order to constitute a quorum for the transaction of business. Abstentions and broker non-votes will be counted for purposes of determining the presence or absence of a quorum. Broker non-votes occur when a nominee holding shares for a beneficial owner does not have discretionary voting power on a matter and has not received instructions from the beneficial owner.

How to Vote; How Proxies Work

Our Board of Directors (the “Board of Directors” or the “Board”) is asking for your proxy. Whether or not you plan to attend the Meeting, we urge you to vote by proxy as you can always change your vote at the Meeting. Please provide your proxy by voting on the Internet or by telephone, or complete, date and sign the enclosed proxy card and return it at your earliest convenience. We will bear the costs incidental to the solicitation and obtaining of proxies, including the costs of reimbursing banks, brokers and other nominees for forwarding proxy materials to beneficial owners of our capital stock. Proxies may be solicited by our officers and employees, without extra compensation, in person, by telephone, and by other methods of communication.

At the Meeting, and at any postponements and adjournments thereof, all shares entitled to vote and represented by properly executed proxies received prior to the Meeting and not revoked will be voted as instructed on those proxies. If no instructions are indicated on a properly executed proxy, the shares will be voted “FOR” each of the nominees for director, “FOR” the ratification of Wipfli LLP as our independent registered public accounting firm for the year ending December 31, 2022, “FOR” the non-binding advisory approval of the compensation of our named executive officers, and in the discretion of the proxies on any other matter which may properly come before the Meeting.

Questions and Answers

| Q. | What am I voting on? |

You are voting on three proposals:

Proposal No.1: For the election of four (4) nominees to our Board of Directors, each to serve until the next Annual Meeting of Stockholders and until his successor has been elected and qualified, or until his earlier death, resignation, disqualification, or removal.

Proposal No.2: For ratification of the selection of Wipfli LLP as our independent registered public accounting firm for the year ending December 31, 2022.

Proposal No.3: To provide a non-binding advisory approval of the compensation of our named executive officers.

| 4 |

| Q. | Who is entitled to vote? |

Only holders of record of our common stock and holders of record of our Series A Preferred Stock and Series B Preferred Stock at the close of business on March 29, 2022, the Record Date, are entitled to vote shares held by such stockholders on that date at the Meeting.

| Q. | How do I vote? |

Vote by Internet: Visit the website noted on your proxy card to vote via the Internet.

Vote By Telephone: Call the number noted on your proxy card to vote by telephone.

Vote By Mail: Sign and date the proxy card you receive and return it in the enclosed stamped, self-addressed envelope.

Vote in Person: Sign and date the proxy you receive and return it in person at the Meeting. If your shares are held in the name of a bank, broker or other holder of record (i.e., in “street name”), you will receive instructions from the holder of record that you must follow in order for your shares to be voted. Internet voting will be offered to stockholders owning shares through most banks and brokers.

| Q. | How many votes do I have? |

On each matter to be voted upon, each share of common stock is entitled to one vote, each share of Series A Preferred Stock is entitled to 13,774 votes and each share of Series B Preferred Stock is entitled to 38,461 votes.

| Q. | How many shares were outstanding on the Record Date? |

At the close of business on March 29, 2022, the Record Date, there were 303,760,444 shares outstanding (counting our Series A Preferred Stock and our Series B Preferred Stock on an as-converted basis, representing an aggregate of 4,548,162 shares of common stock for such purposes).

| Q. | What is a “quorum” for purposes of the Meeting? |

In order to conduct business at the Meeting, a quorum of stockholders is necessary to hold a valid meeting. Holders of our Series A Preferred Stock and holders of our Series B Preferred Stock will each vote on an as-converted basis together with holders of our common stock as a single class in connection with each of the proposals contained in this proxy statement. At least a majority of our shares outstanding on the Record Date and entitled to vote (counting our Series A Preferred Stock on an as-converted basis and our Series B Preferred Stock on an as-converted basis, representing an aggregate of 4,548,162 shares of common stock for such purposes) must be represented at the Meeting, either in person or by proxy, in order to constitute a quorum for the transaction of business. At the close of business on the Record Date, there were 303,760,444 shares outstanding and entitled to vote (counting our Series A Preferred Stock on an as-converted basis and our Series B Preferred Stock on an as-converted basis, representing an aggregate of 4,548,162 shares of common stock for such purposes) and, accordingly, the presence, in person or by proxy, of at least 151,880,222 shares is necessary to meet the quorum requirement.

Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other nominee) or if you vote in person at the Meeting. Abstentions and broker non-votes will be counted towards the quorum requirement. If there is no quorum, the holders of a majority of shares present at the Meeting in person or represented by proxy may adjourn the Meeting to another date.

| 5 |

| Q. | Who is paying for this proxy solicitation? |

The Company will pay for the entire cost of soliciting proxies, including the printing and filing of this proxy statement, the proxy card and any additional information furnished to stockholders. In addition, our directors and employees may also solicit proxies in person, by telephone, or by other means of communication. Directors and employees will not be paid any additional compensation for soliciting proxies. We will also reimburse brokerage firms, banks and other agents for the reasonable out-of-pocket expenses they incur to forward proxy materials to beneficial owners.

| Q. | What if I return a proxy card but do not make specific choices? |

All shares for which a proxy has been properly submitted and not revoked will be voted at the Meeting in accordance with your instructions. If you sign your proxy card but do not give voting instructions, the shares represented by that proxy will be voted in the discretion of the proxies. The proxies intend to vote in favor of the election of each director nominee listed in Proposal No. 1, and in favor of Proposal Nos. 2, and 3.

If any other matter is properly presented at the Meeting, your proxy (one of the individuals named on your proxy card) will vote your shares using his or her best judgment.

| Q. | Can I access the proxy materials electronically? |

This proxy statement, the proxy card, and our Annual Report on Form 10-K for the period ended December 31, 2021 are available on the following website at http://www.proxyvote.com.

| Q. | Can I change my vote or revoke my proxy? |

Yes. You may change your vote or revoke your proxy at any time before the proxy is exercised. Proxies may be revoked by:

| ● | Filing with the Secretary of Telkonet, at or before the taking of the vote at the Meeting, a written notice of revocation dated later than the proxy; | |

| ● | Voting again at a later date (but prior to the Meeting) on the Internet or by telephone; | |

| ● | Executing a later dated proxy relating to the same shares of capital stock and delivering it to the Secretary of Telkonet, including by facsimile, before the taking of the vote at the Meeting; or | |

| ● | Attending the Meeting and voting in person. |

Any written revocation or subsequent proxy should be sent so as to be delivered to Telkonet, Inc., 20800 Swenson Drive, Suite 175, Waukesha, WI 53186, Attention: Corporate Secretary, or hand delivered to the Secretary of Telkonet or his representative at or before the taking of the vote at the Meeting. Attendance at the Meeting will not have the effect of revoking a proxy unless you give written notice of revocation to the Corporate Secretary before the proxy is exercised or you vote by written ballot at the Meeting.

| Q. | What is the process for admission to the Meeting? |

If you are a record owner of your shares (i.e., your shares are held in your name), you must show government issued identification. Your name will be verified against the stockholder list. If you hold your shares through a bank, broker or other nominee, you must also bring a copy of your latest bank or broker statement showing your ownership of your shares as of the Record Date.

| 6 |

| Q. | How many votes are required to approve matters to be presented? |

Each of our Series A Preferred Stock and Series B Preferred Stock is entitled to vote on Proposal Nos. 1, 2, and 3 on an as-converted basis with our common stock as a single class. Each share of common stock is entitled to one vote; each share of Series A Preferred Stock is entitled to 13,774 votes on each of the proposals contained in this proxy statement; and each share of Series B Preferred Stock is entitled to 38,461 votes on each of the proposals contained in this proxy statement.

We have described the vote necessary for each Proposal in the description of that Proposal. Voting ceases when the polls are closed at the Annual Meeting. In determining whether a majority of the shares of the common stock (counting our Series A Preferred Stock and Series B Preferred Stock each on an as-converted basis) present at the Meeting in person or by proxy have been affirmatively voted for a particular proposal, except in the election of directors, the affirmative votes for the proposal are compared to the votes against the proposal plus the abstentions from voting on the proposal. You may abstain from voting on any proposal. Except in the election of directors, abstentions from voting are not considered as votes affirmatively cast and therefore will have the effect of a vote against a proposal. With regard to the election of directors, abstentions will be excluded entirely from the vote and will have no effect.

| Q. | How will my shares held in street name be voted if I do not provide voting instructions? |

If you are a beneficial owner of shares held in street name and do not provide the organization that holds your shares with specific voting instructions, under the rules of various national and regional securities exchanges, the organization that holds your shares may generally vote on routine matters but cannot vote on non-routine matters, including the election of directors and proposals relating to executive compensation. Accordingly, if you are a street-name holder and do not provide instructions to your broker on Proposal No. 1 or Proposal No. 3, your broker may not vote your shares on such proposals; thus we strongly encourage you to submit your voting instruction card and exercise your right to vote as a stockholder.

| Q. | What are the recommendations of the Board of Directors? |

The Board of Directors unanimously recommends that the stockholders vote:

| · | FOR each of the nominees for director listed in Proposal No. 1; | |

| · | FOR ratification of the appointment of Wipfli LLP as our independent registered public accounting firm for the year ending December 31, 2022 in Proposal No. 2; and | |

| · | FOR non-binding advisory approval of the compensation of our Named Executive Officers (as defined below) in Proposal No. 3. |

With respect to any other matter that properly comes before the Meeting, the proxies may use their discretion to determine how to vote.

| 7 |

PROPOSAL NO. 1

ELECTION OF DIRECTORS

The first proposal to be voted on at the Meeting is the election of four (4) directors. Telkonet’s bylaws establish the number of directors at not less than three (3) members. Pursuant to the bylaws, the Board of Directors may increase or decrease the number of members of the Board of Directors. Upon the Nominating Committee’s recommendation, the Board of Directors has nominated all of the current directors for re-election to the Board of Directors. Jason L. Tienor resigned from the Board of Directors and the Company effective March 31, 2022, and the Nominating Committee is currently considering his successor, who will be appointed by vote of a majority of directors then in office pursuant to the Company’s bylaws. Each of the nominees has consented to serve as a nominee, to be named as a nominee in this proxy statement, and to serve as a director if elected. At the Meeting, the shares represented by properly executed proxies, unless otherwise specified, will be voted for the election of the four (4) nominees named herein, each to serve until the next Annual Meeting of Stockholders and until his successor is duly elected and qualified, or until his earlier death, resignation, disqualification, or removal. If for any reason any nominee is not a candidate when the election occurs (which is not expected), the Board of Directors expects that proxies will be voted for the election of a substitute nominee designated by the Board of Directors.

The following information is furnished concerning each nominee for election as a director.

Nominees for Election at the Annual Meeting

| Director Name | Age | Position With Telkonet | Director Since | |||

| Flavio De Paulis | 46 | Director (2)(3) | 2022 | |||

| Piercarlo Gramaglia | 46 | Director and Chief Executive Officer (3) | 2022 | |||

| Steven E. Quick | 59 | Chairman of the Board (1)(2) | 2022 | |||

| Tim S. Ledwick | 64 | Director (1)(3) | 2012 |

| (1) | Member of the Audit Committee | |

| (2) | Member of the Compensation Committee | |

| (3) | Member of the Nominating Committee |

FLAVIO DE PAULIS. Director, Mr. De Paulis has 20 years of professional experience, including having served in roles with Accenture (Italy) in business consulting and Credit Suisse (Switzerland) in the Credit and Risk Management Department. From 2004 to 2014, Mr. De Paulis served as a vice president of Private Swiss Bank, where his responsibilities included fundraising and placement activities in the Italian market. In August 2015, Mr. De Paulis became the managing partner of JCI Capital LLC, an investment banking boutique with offices in London and Milan where he served until July 2018. Since August 2017, Mr. De Paulis has served as a director of Meti Holding Sarl (“Meti”), his family office and a holding company. Through Meti, Mr. De Paulis bought a minority stake of thirty four percent (34%) in VDA Holding S.A. (“VDA Parent”), the parent of VDA Group S.p.A. (“VDA”), in 2018, and increased the same in 2019, becoming the majority shareholder of VDA Parent, which he, indirectly through Meti, remains to date. Mr. De Paulis has a variety of skills and know-how in wealth management and family office solutions, M&A, and private-equity transactions, and has a very successful track record in building and leveraging networks and relationships to contribute to the growth of business organizations. He has expertise in strategic planning and implementation – guiding and directing enterprises through substantial change management by utilizing strong and effective strategic leadership which he will apply through his positions with the Company. Mr. De Paulis has a Bachelor of Business Administration from Bocconi University and a Ph.D. in Economics from Università degli Studi di Cassino e del Lazio Meridionale and became a Certified Charter Accountant in 2005.

PIERCARLO GRAMAGLIA. Director, Mr. Gramaglia serves as the Company’s Chief Executive Officer. Mr. Gramaglia brings to the Company a wealth of knowledge and experience with respect to mid-size companies with a core business involving the manufacture of products. Mr. Gramaglia’s prior professional experience include sales and marketing with a focus on business development and mergers and acquisitions, with specific competences in turnaround projects based on topline development. Mr. Gramaglia has worked with a variety of companies and entrepreneurial groups, including Urmet S.p.A., an integrated building communication and security systems manufacturer, and Gewiss S.p.A., a provider of energy and light products services, for which Mr. Gramaglia served as the International Sales Director from 2016 to March 2017, various publicly listed Italian companies (Nice), and a group held by a financial investor, Targetti Sankey, S.p.A., a lighting design and manufacturing firm, for which Mr. Gramaglia served as the Chief Executive Officer from March 2017 to April 2018. Mr. Gramaglia has served as the Chief Executive Officer and director of VDA since April 2019. Mr. Gramaglia has also served as a Partner of OPES Mind, a management consulting firm, since July 2020. Mr. Gramaglia has a degree in Marketing and Export Trade from Università degli Studi di Torino.

| 8 |

STEVEN E. QUICK. Chairman of the Board, Mr. Quick has served as the chief executive officer of Unispace Global Pty Ltd. (“Unispace”), a global design and build company that operates globally in 25 countries, since September 2020. Mr. Quick was instrumental in the buyout of the founders and recapitalization of Unispace with private-equity ownership. Prior to Unispace, Mr. Quick served as the Chief Executive of Global Occupier Services (“GOS”) at Cushman & Wakefield from November 2013 to September 2020, where he led GOS to tremendous growth, as measured by revenue and EBITA, and transformed the strategic direction of the business, which included the segmentation of key markets. Mr. Quick has a Bachelor of Science from Illinois State University and a Master of Business Administration from the University of South Florida. Mr. Quick is also a Certified Public Accountant, licensed in Illinois and Florida, and a Certified Valuation Analyst.

TIM S. LEDWICK. Director, Mr. Ledwick has served as a director since April 2012. Mr. Ledwick has over 20 years’ experience as a CFO in both public and private companies. Mr. Ledwick is currently the Chief Financial Officer of Syft, a private equity-backed company that provides software solutions and services to hospitals focused on reducing costs through superior inventory management practices. From 2007 to 2011, Mr. Ledwick provided CFO consulting services to a variety of companies including a $150 million services firm. Mr. Ledwick currently serves on the Board of Directors at Aikido Pharma, Inc. (AIKI), a NASDAQ-listed biotechnology development company, and is the Chair of the Audit Committee of Aikido Pharma, Inc. Mr. Ledwick is a member of the Connecticut Society of Certified Public Accountants and received his BBA in Accounting from The George Washington University and his MS in Finance from Fairfield University. We believe Mr. Ledwick’s qualifications to sit on our Board include his background in public accounting as well as his financial executive experience.

Required Vote

Directors are elected by a plurality of the votes cast by holders of shares of our common stock, our Series A Preferred Stock and our Series B Preferred Stock, voting together as a single class on an as-converted basis, entitled to vote at the Meeting, either in person or by proxy. Votes may be cast in favor of a nominee or withheld. Because directors are elected by plurality, abstentions from voting and broker non-votes will be excluded from the vote on this proposal and will have no effect on its outcome. If a quorum is present at the Meeting, the four nominees receiving the greatest number of votes will be elected. For beneficial owners of shares held in street name, brokers are prohibited from giving proxies to vote on the election of directors unless the beneficial owner has given voting instructions as to each director. This means that if your broker is the record holder of your shares you must give voting instructions to your broker if you want your broker to vote your shares for the election of directors.

THE BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS

VOTE “FOR” THE ELECTION OF EACH NOMINEE

| 9 |

PROPOSAL NO. 2

RATIFICATION OF APPOINTMENT OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Wipfli, LLP (“Wipfli”), has served as the Company’s independent registered public accounting firm since April 2020 and has been retained to do so in 2022. The Board of Directors has directed that management submit the selection of Wipfli for ratification by the stockholders at the Meeting.

Stockholder ratification of the selection of Wipfli as the Company’s independent registered public accounting firm is not required. However, the Board of Directors is submitting the selection of Wipfli to the stockholders for ratification as a matter of good corporate practice. If the stockholders do not ratify the selection, the Audit Committee will reconsider whether to retain the firm in future years. In such event, the Audit Committee may retain Wipfli, notwithstanding the fact that the stockholders did not ratify the selection, or select another accounting firm without re-submitting the matter to the stockholders. Even if the selection is ratified, the Audit Committee reserves the right, in its discretion, to select a different accounting firm at any time during the year if it determines that such a change would be in the best interests of the Company and its stockholders.

Representatives of Wipfli will not be present at the Meeting, will not have an opportunity to make a statement if they desire to do so, and will not be available to respond to appropriate questions.

Independent Registered Public Accounting Firm Fees and Services

The following table sets forth fees billed, or expected to be billed, to the Company by Wipfli for the fiscal years ended December 31, 2021 and 2020.

December 31, 2021 | December 31, 2020 | |||||||

| Audit Fees (1) | $ | 191,739 | $ | 227,587 | ||||

| Audit-Related Fees (2) | 0 | 0 | ||||||

| Tax Fees (3) | 31,800 | 31,000 | ||||||

| All Other Fees (4) | 0 | 0 | ||||||

| Total Fees | $ | 223,539 | $ | 258,587 | ||||

| (1) |

Audit fees consist of fees billed for professional services rendered for the audit of the Company’s consolidated financial statements and review of the interim consolidated financial statements included in quarterly reports and services that are normally provided by Wipfli in connection with statutory and regulatory filings or engagements. | |

| (2) |

Audit-Related fees consist of fees billed for assurance and related services that are reasonably related to the performance of the audit or review of the Company’s consolidated financial statements and are not reported under “Audit Fees.” These services include accounting consultations in connection with transactions, merger and acquisition due diligence, attest services that are not required to support the integrated audit of the Company’s consolidated financial statements and its internal controls over financial reporting and consultations concerning financial accounting and reporting standards. | |

| (3) |

Tax fees consist of fees billed for professional services for tax return preparation and filing, compliance, advice and planning. The tax fees relate to federal and state income tax reporting requirements. | |

| (4) | All other fees consist of fees for professional products and services other than the services reported above. |

| 10 |

Prior to the Company’s engagement of its independent registered public accounting firm, such engagement is approved by the Company’s Audit Committee. The services provided under this engagement may include audit services, audit-related services, tax services and other services. Pre-approval is generally provided for up to one year and any pre-approval is detailed as to the particular service or category of services and is generally subject to a specific budget. Pursuant to the Audit Committee Charter, the independent registered public accounting firm and management are required to report to the Company’s Audit Committee at least quarterly regarding the extent of services provided by the independent registered public accounting firm in accordance with this pre-approval, and the fees for the services performed to date. The Audit Committee may also pre-approve particular services on a case-by-case basis. All audit fees, audit-related fees, tax fees and other fees incurred by the Company for the year ended December 31, 2021 were approved by the Company’s Audit Committee.

Required Vote

The affirmative vote of a majority of the shares of the common stock (counting our Series A Preferred Stock and Series B Preferred Stock each on an as-converted basis) present at the Meeting in person or by proxy is required to ratify the appointment of Wipfli as the Company’s independent registered public accounting firm. For beneficial owners of shares held in street name, brokers have discretion and may give proxies on Proposal No. 2 whether or not they receive instructions from the beneficial owners of those shares.

THE BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS

VOTE “FOR” THE APPROVAL OF THIS PROPOSAL NO. 2

| 11 |

PROPOSAL NO. 3

NON-BINDING ADVISORY VOTE TO APPROVE

THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS

We are providing our stockholders the opportunity to vote to approve, on an advisory, non-binding basis, the compensation of our Named Executive Officers (as defined below) in accordance with the rules of the Securities and Exchange Commission (the “SEC”). This proposal, which is commonly referred to as "say-on-pay," is required by the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (the “Dodd-Frank Act”). The Company has decided to conduct advisory votes on our Named Executive Officers’ compensation annually until the next required advisory vote on the frequency of the advisory vote on the Company’s executive compensation in 2024. The Named Executive Officers are the Company’s Chief Executive Officer (principal executive officer) and the other two most highly compensated executive officers as of December 31, 2021, which included Jason L. Tienor (then Chief Executive Officer), Jeffrey J. Sobieski (Chief Technology Officer) and Richard E. Mushrush (Chief Financial Officer) (together, the “Named Executive Officers”).

Our executive compensation programs are designed to attract, motivate and retain our executive officers, who are critical to our success. Under these programs, our Named Executive Officers are rewarded for the achievement of our near-term and longer-term financial and strategic goals and for driving corporate financial performance and stability. The programs contain elements of cash and equity-based compensation and are designed to align the interests of our executives with those of our stockholders.

The section titled "Executive Compensation" of this proxy statement describes in detail our executive compensation programs and the decisions made by the Compensation Committee with respect to the fiscal year ended December 31, 2021. As we describe in this section of the proxy statement, our executive compensation program incorporates a pay-for-performance philosophy that supports our business strategy and aligns the interests of our executives with our shareholders. This link between compensation and the achievement of our near- and long-term business goals is intended to drive our performance over time.

Our Board of Directors is asking stockholders to approve a non-binding advisory vote on the following resolution:

RESOLVED, that the compensation paid to the Company's Named Executive Officers, as disclosed pursuant to the compensation disclosure rules of the Securities and Exchange Commission, including the disclosure under the section titled "Executive Compensation" of this proxy statement, the compensation tables and accompanying narrative disclosure, and any related material disclosed in this proxy statement, is hereby approved.

As an advisory vote, this proposal is not binding. The outcome of this advisory vote does not overrule any decision by the Company or the Board of Directors (or any committee thereof), create or imply any change to the fiduciary duties of the Company or the Board of Directors (or any committee thereof), or create or imply any additional fiduciary duties for the Company or the Board of Directors (or any committee thereof). However, our Compensation Committee and Board of Directors value the opinions expressed by our stockholders in their vote on this proposal and will consider the outcome of the vote when making future compensation decisions for the Named Executive Officers.

Required Vote

The affirmative vote of a majority of the shares of the common stock (counting our Series A Preferred Stock and Series B Preferred Stock each on an as-converted basis) present at the Meeting in person or by proxy is required to approve the resolution. For beneficial owners of shares held in street name, brokers are prohibited from giving proxies to vote on executive compensation matters unless the beneficial owner has given voting instructions as to each director. This means that if your broker is the record holder of your shares you must give voting instructions to your broker if you want your broker to vote your shares on this matter.

THE BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS

VOTE “FOR” THE APPROVAL OF THIS PROPOSAL NO. 3

| 12 |

INFORMATION ABOUT OUR BOARD OF DIRECTORS

Meetings of the Board and Committees

The Board of Directors held no formal meetings in 2021, but did conduct a number of informal conference call meetings during the year. Each member of the Board of Directors attended at least seventy-five percent (75%) of the conference call meetings of the Board of Directors and the committees of which such director was a member. The Company has not established a formal policy requiring director attendance at all Board meetings, but the Company expects each director to attend such meetings, absent unusual circumstances. The Company also expects its directors to make an effort to attend the Annual Meeting of Stockholders. One member of the Company’s Board of Directors attended the 2021 Annual Meeting of Stockholders.

Code of Ethics

The Board has approved, and the Company has adopted, a Code of Ethics that applies to all directors, officers and employees of the Company. This Code of Ethics was included as an exhibit to the Company’s Form 10-KSB filed with the SEC on March 30, 2004.

Director Independence

The Board of Directors has determined that Messrs. Ledwick and Quick are “independent” under the listing standards of the OTCQB.

Board Leadership Structure and Role in Risk Oversight

Mr. Quick currently serves as Chairman of the Board of Directors while Mr. Gramaglia serves as our Chief Executive Officer. The Board believes this structure is appropriate at this time because it allows the Company to benefit from the unique experience and skills of each of these individuals. Management of risk is the direct responsibility of the Company’s Chief Executive Officer and the senior leadership team. The Board has oversight responsibility, focusing on the adequacy of the Company’s enterprise risk management and risk mitigation processes.

Communications with the Board of Directors

Stockholders can communicate directly with the Board, with any Committee of the Board, or specified directors by writing to: The Board of Directors of the Company, at the Company’s principal business address or by calling at (414) 302-2299. All communications will be reviewed by management and then forwarded to the appropriate director, directors, committee or to the entire Board of Directors.

Committees of the Board of Directors

The Board has an Audit Committee, a Compensation Committee and a Nominating Committee.

Nominating Committee

Messrs. De Paulis, Gramaglia and Ledwick currently serve on the Company’s Nominating Committee, with Mr. Gramaglia serving as the Chairman of the committee. The written charter for the Nominating Committee is posted on the Company’s website at the following: https://ir.telkonet.com/governance-docs. The Nominating Committee did not hold any formal meetings in 2021, but reviewed the current directors and formally recommended all of the current directors for re-election to the Board.

| 13 |

Our Board is a collection of individuals with a variety of complementary skills derived from their diverse backgrounds and experiences. When considering potential candidates for election to the Board, the Company’s Nominating Committee evaluates various criteria, including, but not limited to, each candidate’s business and professional skills, experience serving in management or on the board of directors of companies similar to the Company, financial literacy and personal integrity in judgment. The Company does not have a specific policy regarding diversity and believes that the backgrounds and qualifications of the directors, considered as a group, should provide a diverse mix of experiences, knowledge, attributes and abilities that will allow the Board to fulfill its responsibilities. Candidates for vacant board seats will be considered if they are able to read and understand fundamental financial statements, have no identified conflicts of interest, have not been convicted in a criminal proceeding other than traffic violations during the ten years before the date of selection and are willing to comply with the Company’s Code of Ethics. One or more directors must have the requisite financial expertise to qualify as an “audit committee financial expert” as defined by Item 407 of Regulation S-K promulgated under the Securities Exchange Act of 1934. The Nominating Committee reserves the right to modify these minimum qualifications from time to time.

The Nominating Committee reviews the qualifications and backgrounds of the directors, as well as the overall composition of the Board, from time to time without assigning specific weight to particular experiences or qualifications. In addition, the Nominating Committee considers whether the Board as a whole possesses the right skills and background to address the issues facing our Company at that time. In the case of any candidate for a vacant Board seat, the Nominating Committee will consider whether the candidate meets the applicable independence standards and will evaluate the level of the candidate’s financial expertise. Any new candidates will be interviewed by the Nominating Committee, and the entire Board will approve the final nominations. The Chairman of the Board, acting on behalf of the full Board, will extend the formal invitation to become a nominee of the Board of Directors.

Stockholders may nominate director candidates for consideration by the Board of Directors by directing the recommendation in writing to the Company, attention Corporate Secretary, 20800 Swenson Drive, Suite 175, Waukesha, WI 53186 and providing the candidate’s name, biographical data and qualifications, including five-year employment history with employer names and a description of the employer’s business; whether such individual can read and understand fundamental financial statements; other board memberships (if any); and such other information as is reasonably available and sufficient to enable the Board to evaluate the minimum qualifications described above. The submission must be accompanied by the written consent of the individual to stand for election if nominated by the Board of Directors and to serve if elected by the stockholders. If a stockholder nominee is eligible, and if the nomination is proper and in accordance with the Company’s bylaws, the independent directors then will deliberate and make a decision as to whether the candidate will be submitted to the Company’s stockholders for a vote. The Board will not change the manner in which it evaluates candidates, including the applicable minimum criteria set forth above, based on whether the candidate was recommended by a stockholder.

Audit Committee

The Audit Committee is currently comprised of Messrs. Ledwick and Quick, with Mr. Ledwick serving as Chairman of the Audit Committee. The Company’s Board of Directors has determined that each of Messrs. Ledwick and Quick is an “audit committee financial expert” as defined by Item 407 of Regulation S-K promulgated under the Securities Exchange Act of 1934.

The Audit Committee recommends annually to the Board of Directors the selection of the independent registered public accounting firm for each fiscal year, confirms and assures their independence and approves the fees and other compensation to be paid to the auditors. The Audit Committee recommends to the Board the advisability of having the independent registered public accounting firm make specified studies and reports as to auditing matters, accounting procedures, tax or other matters. The Audit Committee also reviews, prior to its filing with the SEC, the Company’s Form 10-K and annual report to stockholders. The Audit Committee provides an open avenue of communication among the independent registered public accounting firm, management and the Board of Directors and will review any significant disagreement among management and the independent registered public accounting firm in connection with the preparation of any of the Company’s financial statements. The Audit Committee has also established procedures for the receipt, retention and treatment of any complaints received by the Company regarding accounting, internal accounting controls or auditing matters and the confidential, anonymous submission by the Company’s employees of any concerns regarding questionable accounting or auditing matters. In addition, the Audit Committee reviews, with the Company’s legal counsel, legal and regulatory matters that may have a significant impact on the Company’s financial statements. The Audit Committee held four meetings in 2021; Mr. Ledwick attended all of the meetings.

| 14 |

The Board of Directors has adopted an Audit Committee Charter, which is posted on the Company’s website at the following: https://ir.telkonet.com/governance-docs.

Compensation Committee

Mr. De Paulis and Mr. Quick currently serve on the Company’s Compensation Committee, with Mr. Quick serving as the Chairman of the committee. The Compensation Committee oversees the Company’s compensation programs, which are designed specifically for the Company’s most senior executive officers, including the Chief Executive Officer, Chief Financial Officer and the other executive officers. The Compensation Committee also oversees the compensation programs for the Company’s non-employee directors, and recommends such compensation programs to the Board for its approval. Additionally, the Compensation Committee is charged with the review and approval of all annual compensation decisions relating to Named Executive Officers. The Compensation Committee may consult with executive officers in determining or recommending the amount or form of executive and/or non-employee director compensation, as needed. The Compensation Committee may establish sub-committees consisting of one or more members to carry out duties that the Compensation Committee may assign. The Compensation Committee did not engage a compensation consultant in 2021. The Board of Directors has adopted a Compensation Committee charter. The written charter is posted on the Company’s website at the following: https://ir.telkonet.com/governance-docs. The Compensation Committee did not hold any formal meetings in 2021.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth, as of March 29, 2022, the number of shares of the Company’s common stock and Series A Preferred Stock beneficially owned by each director and Named Executive Officer of the Company, by all directors and executive officers as a group and by persons who beneficially own more than five percent (5.0%) of any class of the Company’s outstanding stock. No directors or officers owned Series B Preferred Stock. Other than as noted below, the Company does not know of any person who beneficially owns more than five percent (5.0%) of the Company’s outstanding common stock, Series A Preferred Stock, and Series B Preferred Stock.

| Common Stock | Series A Preferred Stock | ||||||||||||||||||||

| Name and Address (1) | Number of Shares (2) | Percentage of Class | Number of Shares | Percentage of Class | Percentage of Voting Securities | ||||||||||||||||

| VDA Group S.p.A. | 162,900,947 | 53.9% | 0 | 0 | 53.4% | (3) | |||||||||||||||

| VDA Holding S.A. | 162,900,947 | 53.9% | 0 | 0 | 53.4% | (4) | |||||||||||||||

| Meti Holding Sarl | 162,900,947 | 53.9% | 0 | 0 | 53.4% | (4) | |||||||||||||||

| Directors and Executive Officers | |||||||||||||||||||||

| Tim S. Ledwick, Director | 1,029,781 | * | 0 | 0 | * | (5) | |||||||||||||||

| Flavio De Paulis, Director | 162,900,947 | 53.9% | 0 | 0 | 53.4% | (6) | |||||||||||||||

| Steven E. Quick, Director | 0 | 0 | 0 | 0 | 0 | ||||||||||||||||

| Jeffrey J. Sobieski, Chief Technology Officer | 2,382,965 | * | 4 | 2.2 | 1.7 | (7) | |||||||||||||||

| Richard E. Mushrush, Chief Financial Officer | 152,902 | * | 0 | 0 | * | (8) | |||||||||||||||

| Jason L. Tienor, Chief Sales & Operations Officer of the Americas and Director | 2,688,793 | * | 4 | 2.2 | 1.9 | (9) | |||||||||||||||

| Piercarlo Gramaglia, Chief Executive Officer and Director | 0 | 0 | 0 | 0 | 0 | ||||||||||||||||

| All Directors and Executive Officers as a group (persons) | 169,155,388 | 55.9% | 8 | 4.4% | 55.5% | ||||||||||||||||

| * | Less than one percent (1%) |

| 15 |

| (1) | Unless otherwise indicated, the address of each named holder is in care of Telkonet, Inc., 20800 Swenson Drive, Suite 175, Waukesha, Wisconsin 53186. |

| (2) | According to SEC rules, beneficial ownership includes shares as to which the individual or entity has voting power or investment power and any shares which the individual or entity has the right to acquire within 60 days of the date of this table through the exercise of any stock option or other right. |

| (3) | The address of VDA Group S.p.A. is Viale Lino Zanussi, 3, 33170 Pordenone PN, Italy. Based on a Schedule 13D/A filed on January 19, 2022, VDA Group S.p.A reports sole voting and sole dispositive power of 0 shares of common stock and shared voting and shared dispositive power over 162,900,9470 shares of common stock. |

| (4) | The address of VDA Holding S.A. and Meti Holding Sarl is 26, Boulevard Royal, L-2449 Luxembourg. Based on a Schedule 13D/A filed on January 19, 2022, VDA Holding S.A. and Meti Holding Sarl report sole voting and sole dispositive power of 0 shares of common stock and shared voting and shared dispositive power over 162,900,9470 shares of common stock. |

| (5) | Includes 929,781 shares of our common stock and options exercisable within 60 days to purchase 100,000 shares of our common stock at $0.19 per share. |

| (6) | The address of Mr. De Paulis is 26, Boulevard Royal, L-2449 Luxembourg. Based on a Schedule 13D/A filed on January 19, 2022, Mr. De Paulis reports sole voting and sole dispositive power of 0 shares of common stock and shared voting and shared dispositive power over 162,900,9470 shares of common stock. |

| (7) | Includes 1,055,279 shares of our common stock, options exercisable within 60 days to purchase 110,833, 161,757 and 1,000,000 shares of our common stock at $0.18, $0.185 and $0.14 per share, respectively, and 55,096 shares of our common stock issuable upon conversion of shares of our Series A Preferred Stock. |

| (8) | Includes options exercisable within 60 days to purchase 78,041 and 74,861 shares of our common stock at $0.185 and $0.18 per share, respectively. |

| (9) | Includes 1,251,114 shares of our common stock, options exercisable within 60 days to purchase 155,556, 227,027 and 1,000,000 shares of our common stock at $0.18, $0.185 and $0.14 per share, respectively, 55,096 shares of common stock issuable upon conversion of shares of our Series A Preferred Stock. |

DIRECTOR COMPENSATION

Non-Employee Director Compensation Philosophy

Our non-employee director compensation philosophy is based on the following guiding principles:

| · | Aligning the long-term interests of stockholders and directors; and |

| · | Compensating directors appropriately and adequately for their time, effort, and experience. |

We reimburse directors for costs and expenses in connection with their attendance and participation at Board of Directors meetings and for other travel expenses incurred on our behalf. Messrs. Ledwick and Quick are compensated $30,000 per annum payable in cash for their service on the Board. Mr. De Paulis is compensated $20,000 per annum payable in cash for his service on the Board. Mr. Gramaglia is not compensated for his service on the Board.

| 16 |

Non-Employee Director Compensation for Year Ended December 31, 2021

The following table summarizes all compensation paid to our non-employee directors who were members of the Board during the year ended December 31, 2021.

| Name |

Fees Earned or Paid in Cash ($) |

|||||

| Peter T. Kross | $ | 36,000 | ||||

| Tim S. Ledwick | 60,000 | |||||

| Arthur E. Byrnes | 36,000 | |||||

| Leland D. Blatt | 36,000 | |||||

EXECUTIVE COMPENSATION

Overview of Our Executive Compensation Philosophy

We believe that a skilled, experienced and dedicated executive team is essential to the future performance of our Company and to building stockholder value. We have sought to establish a competitive compensation program that enables us to attract and retain executive officers with these qualities. The goal of our compensation package is to motivate our executive officers to achieve strong financial performance, particularly increased revenues and profitability. We use a salary and a performance incentive compensation program that includes cash and may include equity-based compensation. We believe this aligns the interests of our executives with those of our stockholders.

The following table sets forth certain information with respect to compensation for services in all capacities for the years ended December 31, 2021 and 2020 to our Chief Executive Officer (principal executive officer) and the other two most highly compensated executive officers who were serving as such as of December 31, 2021. We refer to these officers as our “Named Executive Officers.”

Summary Compensation Table

| Name and Principal Position |

Year |

Salary ($) |

All Other Compensation ($)(1) |

Total ($) | ||||||||||

| Jason L. Tienor | 2021 | $ | 222,800 | $ | 12,865 | $ | 235,665 | |||||||

| President and Chief Executive Officer | 2020 | $ | 210,546 | $ | 21,392 | $ | 231,938 | |||||||

| Jeffrey J. Sobieski | 2021 | $ | 211,625 | $ | 19,309 | $ | 230,934 | |||||||

| Chief Technology Officer | 2020 | $ | 199,986 | $ | 23,297 | $ | 223,283 | |||||||

| Richard E. Mushrush | 2021 | $ | 122,000 | $ | 1,519 | $ | 123,519 | |||||||

| Chief Financial Officer | 2020 | $ | 115,290 | $ | 5,086 | $ | 120,376 | |||||||

| (1) | All Other Compensation includes employer matching contributions with respect to each individual’s 401(k) salary deferrals and other employer sponsored benefits paid on the individual’s behalf totaling $4,464, $10,909 and $1,519 in 2021 and $12,992, $14,897, and $5,086 in 2020 for Messrs. Tienor, Sobieski, and Mushrush, respectively. In addition, Messrs. Tienor and Sobieski received a monthly car allowance of $8,400 for each year. |

| 17 |

Salary

Salary is used to recognize the experience, skills, knowledge and responsibilities required of all our employees, including our Named Executive Officers. The salary for each Named Executive Officer is typically set at the time the individual is hired based on the aforementioned factors and the negotiation process between the Company and the Named Executive Officer. Changes to annual salary, if any, are determined based on several factors, including evaluation of performance, anticipated financial performance, economic condition and local market and labor conditions.

Senior Management Annual Incentive Compensation Program

There were no Senior Management Annual Incentive Compensation Programs in 2021 and 2020.

Retirement, Health and Welfare Benefits

The Company offers a variety of health and welfare and retirement programs to all eligible employees. The Named Executive Officers generally are eligible for the same benefit programs on the same basis as all the broad-based employees. The Company’s health and welfare programs include medical, dental, vision, life, accidental death and disability, and short and long-term disability insurance. In addition to the foregoing, the Named Executive Officers are eligible to participate in the Company’s 401(k) Retirement Savings Plan.

401(k) Retirement Savings Plan

The Company maintains a tax-deferred savings plan for employees (the “Telkonet 401(k)”) that is administered by a committee of trustees appointed by the Company. All Company employees are eligible to participate upon the completion of six months of employment, subject to minimum age requirements. Contributions by employees under the Telkonet 401(k) are immediately vested and each employee is eligible for distributions upon retirement, death or disability or termination of employment. Depending upon the circumstances, these payments may be made in installments or in a single lump sum.

Employment Agreements

Jeffrey J. Sobieski, Chief Technology Officer, is employed pursuant to an employment agreement with us effective January 7, 2022. Mr. Sobieski’s employment agreement has an initial term of one (1) year, which will automatically renew for a period of an additional twelve (12) months, and provides for a base salary of $211,625 per year and bonuses and benefits based upon the Company’s internal policies and participation in the Company’s incentive and benefit plans. Per the agreement, Mr. Sobieski is eligible to receive a bonus, not to exceed 15% of his base salary, should predetermined objectives be met.

Richard E. Mushrush, Chief Financial Officer, is employed pursuant to an employment agreement with us effective January 7, 2022. Mr. Mushrush’s employment agreement has an initial term of one (1) year, which will automatically renew for a period of an additional twelve (12) months, and provides for a base salary of $122,000 per year and bonuses and benefits based upon the Company’s internal policies and participation in the Company’s incentive and benefit plans. Per the agreement, Mr. Mushrush is eligible to receive a bonus, not to exceed 20% of his base salary, should predetermined objectives be met.

Each of Mr. Sobieski and Mr. Mushrush is also entitled under his employment agreement to bonuses and benefits consistent with the Company’s internal policies and based on participation in the Company’s incentive and benefit plans. Stock options or other awards may be periodically granted to employees under our equity incentive plan at the discretion of the Compensation Committee of the Board of Directors. Executives of the Company are eligible to receive stock option grants, based upon individual performance and the performance of the Company as a whole.

| 18 |

Each employment agreement contains provisions describing the executive officer’s compensation in the event the executive officer’s employment with the Company is terminated. If (a) an executive officer’s employment agreement is terminated by the mutual consent of the Company and the executive officer, (b) the Company terminates the executive officer’s employment for any reason other than for “cause,” as described below, (c) there is a “change in control” (a sale of all or substantially all of the stock or assets of the Company), or (d) the Company fails to renew the executive officer’s employment agreement upon the expiration of its term and the two 12 month auto-renewal periods have expired, the executive officer will be entitled to receive an amount equal to his base salary for twelve (12) months following the termination, and the Company will pay the executive officer’s health insurance premiums for the same period. If an executive officer terminates his employment with the Company for “good reason,” as described below, he will be entitled to continue to receive his base salary and to participate in each employee benefit plan in which he participated immediately prior to the termination date until (i) the expiration of the term of his employment agreement or (ii) for a period of twelve (12) months, whichever is longer. If cause exists for termination, the executive officer will be entitled to no further compensation, except for accrued leave and vacation and except as may be required by applicable law.

Under each of the employment agreements, “cause” is generally defined as the occurrence of any of the following: (i) theft, fraud, embezzlement or any other act of intentional dishonesty by the executive officer; (ii) any material breach by the executive officer of any provision of his employment agreement that is not cured within fourteen (14) days after written notification by the Company; (iii) any habitual neglect of duty or misconduct of the executive officer in discharging any of his duties and responsibilities under his employment agreement after a written demand for performance was delivered to the executive officer; (iv) commission by the executive officer of a felony or any offense involving moral turpitude; or (v) any default of an executive officer’s obligations under his employment agreement, or any failure or refusal of the executive officer to comply with the Company’s policies, rules and regulations that is not cured within fourteen (14) days after written notification by the Company. “Good reason” is defined as the occurrence of any of the following: (i) any material adverse reduction in the scope of the executive officer’s authority or responsibilities; (ii) any reduction in the amount of the executive officer’s compensation or participation in any employee benefits; or (iii) the executive officer’s principal place of employment is actually or constructively moved to any office or other location seventy-five miles or more outside of Milwaukee, Wisconsin.

Consulting Agreement

Piercarlo Gramaglia serves as Chief Executive Officer of the Company under the terms of a Consulting Agreement, The term is for eighteen (18) months, unless earlier terminated pursuant to the terms of the Consulting Agreement. In exchange for his service as Chief Executive Officer, the Company will pay Mr. Gramaglia an annual fee of $30,000 and will pay his reasonable expenses associated with the performance of his duties as Chief Executive Officer.

Outstanding Equity Awards at Fiscal Year-End Table

The following table shows outstanding stock option awards classified as exercisable and unexercisable as of December 31, 2021 for the Named Executive Officers.

| Name | Grant Date |

Number of Securities Underlying Unexercised Options Exercisable |

Option Exercise Price ($) |

Option Expiration Date (4) | |||||||||

| Jason L. Tienor (former CEO) | 04/01/2012 | 227,027 | (1) | 0.185 | 4/01/2022 | ||||||||

| 04/18/2013 | 155,556 | (2) | 0.18 | 4/18/2023 | |||||||||

| 01/03/2017 | 1,000,000 | (3) | 0.14 | 1/03/2027 | |||||||||

| Jeffrey J. Sobieski | 04/01/2012 | 161,757 | (1) | 0.185 | 4/01/2022 | ||||||||

| 04/18/2013 | 110,833 | (2) | 0.18 | 4/18/2023 | |||||||||

| 01/03/2017 | 1,000,000 | (3) | 0.14 | 1/03/2027 | |||||||||

| Richard E. Mushrush | 04/01/2012 | 78,041 | (1) | 0.185 | 4/01/2022 | ||||||||

| 04/18/2013 | 74,861 | (2) | 0.18 | 4/18/2023 | |||||||||

| (1) | Options were granted on April 1, 2012 and are fully vested. |

| (2) | Options were granted on April 18, 2013 and are fully vested. |

| (3) | Options were granted on January 3, 2017 and are fully vested. |

| (4) | All options granted have a term of ten years. |

| 19 |

Option Exercises and Vesting of Stock Awards

During 2021, there were no options exercised, expired, or vested by the Named Executive Officers.

Named Executive Officer Biographies

PIERCARLO GRAMAGLIA (Age 46): Mr. Gramaglia became our Chief Executive Officer on January 7, 2022, and brings to the Company a wealth of knowledge and experience with respect to mid-size companies with a core business involving the manufacture of products. Mr. Gramaglia’s prior professional experience include sales and marketing with a focus on business development and mergers and acquisitions, with specific competences in turnaround projects based on topline development. Mr. Gramaglia has worked with a variety of companies and entrepreneurial groups, including Urmet S.p.A., an integrated building communication and security systems manufacturer, and Gewiss S.p.A., a provider of energy and light products services, for which Mr. Gramaglia served as the International Sales Director from 2016 to March 2017, various publicly listed Italian companies (Nice), and a group held by a financial investor, Targetti Sankey, S.p.A., a lighting design and manufacturing firm, for which Mr. Gramaglia served as the Chief Executive Officer from March 2017 to April 2018. Mr. Gramaglia has served as the Chief Executive Officer and director of VDA since April 2019. Mr. Gramaglia has also served as a Partner of OPES Mind, a management consulting firm, since July 2020. Mr. Gramaglia has a degree in Marketing and Export Trade from Università degli Studi di Torino.

JEFFREY J. SOBIESKI (Age 46): Mr. Sobieski has served as the Company’s Chief Technology Officer since May 2012. From June 2008 to April 2012, Mr. Sobieski served as the Chief Operating Officer, and from December 2007 to June 2008, he served as the Vice President of Energy Management. He joined Telkonet in March 2007. Prior to joining the Company, Mr. Sobieski co-founded Interactive SolutionZ, a Milwaukee-based IT consulting firm. He holds a bachelor’s degree in computer science from the University of Wisconsin-Oshkosh, and a master’s degree from Marquette University.

RICHARD E. MUSHRUSH (Age 52): Mr. Mushrush has served as the Company’s Chief Financial Officer since January 2017. Before this, he served as Controller of the Company from November 2015 to January 2017 and as Chief Financial Officer of the Company from May 2012 to November 2015. Mr. Mushrush also served as Acting Chief Financial Officer of the Company from November 2010 to April 2012 and as the Company’s Controller from January 2009 to November 2010. Prior to joining the Company, Mr. Mushrush was Controller and Business Unit Manager for a division of Illinois Tool Works from 2004 to 2009.

ANTI-HEDGING PRACTICES

Although we do not have a formal policy related to hedging transactions, we discourage our management and directors from engaging in hedging transactions in connection with our securities. Further, any such transactions would need to comply with our insider trading policies and procedures, as applicable.

Certain Relationships and Related Transactions

Description of Related Party Transactions

There were no related party transactions in 2021 or 2020.

Indemnification Agreements

On March 31, 2010, the Company entered into an Indemnification Agreement with Jeffrey J. Sobieski, then Chief Operating Officer, currently Chief Technology Officer. On April 24, 2012, the Company entered into an Indemnification Agreement with director Timothy S. Ledwick. On January 1, 2017, the Company entered into an Indemnification Agreement with Richard E. Mushrush, Chief Financial Officer.

| 20 |

Each Indemnification Agreement provides that the Company will indemnify the Company's officers and directors, to the fullest extent permitted by law, relating to, resulting from or arising out of any threatened, pending or completed action, suit or proceeding, or any inquiry or investigation by reason of the fact that such officer or director (i) is or was a director, officer, employee or agent of the Company or (ii) is or was serving at the request of the Company as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise if he acted in good faith and in a manner he reasonably believed to be in or not opposed to the best interests of the Company, and, with respect to any criminal action or proceeding, had no reasonable cause to believe his or her conduct was unlawful. In addition, each Indemnification Agreement provides that the Company will make an advance payment of expenses to any officer or director who has entered into an Indemnification Agreement, in order to cover a claim relating to any fact or occurrence arising from or relating to events or occurrences specified in the Indemnification Agreement, subject to receipt of an undertaking by or on behalf of such officer or director to repay such amount if it shall ultimately be determined that he is not entitled to be indemnified by the Company as authorized under the Indemnification Agreement.

REPORT OF THE AUDIT COMMITTEE

Notwithstanding anything to the contrary set forth in any of the Company’s previous filings under the Securities Act of 1933 or the Securities Exchange Act of 1934 that might incorporate future filings or this proxy statement, the following report shall not be deemed to be incorporated by reference into any such filings. In addition, the following report shall not be deemed to be “soliciting material” or “filed” with the SEC.

The Audit Committee for the year ended December 31, 2021, whose members are identified below, has reviewed and discussed the audited financial statements as of and for the year ended December 31, 2021 with the Company’s management and has discussed the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board (“PCAOB”) and the Securities and Exchange Commission with the Company’s independent auditors. The Audit Committee has also received the written disclosures and the letter from the Company’s independent accountant required by applicable requirements of the PCAOB regarding the independent accountant’s communications with the Audit Committee concerning independence and has discussed with the independent accountant the independent accountant’s independence. Based upon its review of the foregoing materials and its discussions with the Company’s management and independent accountant, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2021.

By the Audit Committee.

Tim S. Ledwick

Steven E. Quick

| 21 |

ADDITIONAL INFORMATION

OTHER MATTERS

The Board of Directors does not know of any other matter that may be brought before the Meeting. However, if any such other matters are properly brought before the Meeting or any adjournment of the Meeting, the proxies may use their discretion to determine how to vote your shares.

HOUSEHOLDING

Some banks, brokers and other nominee record holders may be participating in the practice of “householding” proxy statements and annual reports. This means that only one copy of our proxy statement or annual report on Form 10-K may have been sent to multiple stockholders in your household. We will promptly deliver a separate copy of either document to you if you write or call us at the following address or telephone number: 20800 Swenson Drive, Suite 175, Waukesha, WI 53186, (414) 302-2299. If you want to receive separate copies of the annual report on Form 10-K and proxy statement in the future, or if you are receiving multiple copies and would like to receive only one copy for your household, you should contact your bank, broker or other nominee record holders, or you may contact us at the above address and phone number.

STOCKHOLDER PROPOSALS

Stockholders may submit written proposals, including director nominees, to be considered for stockholder action at the Company’s 2023 Annual Meeting of Stockholders. To be eligible for inclusion in the Company’s proxy statement for the 2023 Annual Meeting of Stockholders, stockholder proposals must be received by the Company by December 14, 2022 and must otherwise comply with applicable Securities and Exchange Commission regulations and the Company’s bylaws. Stockholder proposals should be addressed to the Company at 20800 Swenson Drive, Suite 175, Waukesha, WI 53186, Attention: Corporate Secretary. In addition, if a stockholder intends to present a proposal at the Company’s 2023 Annual Meeting of Stockholders without the inclusion of the proposal in the Company’s proxy materials and written notice of the proposal is not received by the Company on or before February 26, 2023, proxies solicited by the Board of Directors for the 2023 Annual Meeting of Stockholders will confer discretionary authority to vote on the proposal if presented at the Meeting. The Company reserves the right to reject, rule out of order or take other appropriate action with respect to any proposal that does not comply with these and other applicable requirements.

Brokers and other persons holding the Company’s common stock in their names, or in the names of a nominee, will be requested to forward this proxy statement and the accompanying materials to the beneficial owners of the common stock and to obtain proxies, and the Company will defray reasonable expenses incurred in forwarding such material.

| By order of the Board of Directors, | |

| /s/ PIERCARLO GRAMAGLIA | |

|

Piercarlo Gramaglia Chief Executive Officer |

Dated: April 12, 2022

| 22 |