UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant S

Filed by a Party other than the Registrant o

Check the appropriate box:

| £ | Preliminary Proxy Statement |

| £ | Confidential, for use of the Commission only (as permitted by Rule 14a-6(e)(2)) |

| S | Definitive Proxy Statement |

| £ | Definitive Additional Materials |

| £ | Soliciting Material Under § 240.14a-12 |

Telkonet, Inc.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

S No fee required.

£ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

£ Fee paid previously with preliminary materials.

| £ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount previously paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

TELKONET, INC.

20800 Swenson Drive

Suite 175

Waukesha, WI 53186

414-302-2299

April 14, 2020

Dear Stockholder:

You are cordially invited to attend the 2020 Annual Meeting of Stockholders of Telkonet, Inc. (the “Company”) to be held on May 28, 2020 at 1:00 p.m., local time, at Telkonet, Inc., 20800 Swenson Dr., Suite 175, Waukesha, WI 53186.

The accompanying Notice of Annual Meeting of Stockholders outlines the matters to be brought forth at the meeting, and the accompanying Proxy Statement discusses these matters in greater detail. Please read both carefully.

Whether or not you plan to attend the meeting, we urge you to complete, date and sign the enclosed proxy card and return it at your earliest convenience. No postage need be affixed if you use the enclosed envelope and it is mailed in the United States. You may also vote by telephone or via the Internet. If you have any questions or need assistance in completing the proxy card or voting by telephone or via the internet, please contact Investor Relations at ir@telkonet.com or call 414-302-2299.

We are mailing this Proxy Statement and a proxy card on or about April 14, 2020 to those stockholders who have indicated a preference to receive paper copies.

Only holders of record of our common stock, par value $0.001 per share, our Series A Preferred Stock, par value $0.001 per share, and our Series B Preferred Stock, par value $0.001 per share, at the close of business on March 31, 2020 are entitled to notice of, and to vote at, the meeting or any adjournment or postponement thereof.

Our proxy statement and the proxy card are enclosed along with our Annual Report on Form 10-K for the fiscal year ended December 31, 2019, which is being provided as our Annual Report to Stockholders. These materials are also available on the following website at http://www.proxyvote.com.

YOUR VOTE IS IMPORTANT.

PLEASE SIGN, DATE AND RETURN THE ENCLOSED PROXY CARD

OR VOTE BY TELEPHONE OR VIA THE INTERNET

IMMEDIATELY, WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING.

We currently intend to hold the 2020 Annual Meeting in person. However, we are actively monitoring the coronavirus (COVID-19) situation and are sensitive to the public health and travel concerns our stockholders may have and the protocols that federal, state, and local governments may impose. In the event it is not possible or not advisable to hold our 2020 Annual Meeting on May 28, 2020, we will announce alternative arrangements for the meeting through all appropriate means as promptly as possible. The alternate arrangements may include a change in the date, time, or location of the meeting, including holding the meeting by remote communication.

| Sincerely yours, | |

| /s/ Jason L. Tienor | |

| Jason L. Tienor | |

| Chief Executive Officer |

TELKONET, INC.

20800 Swenson Drive

Suite 175

Waukesha, WI 53186

414-302-2299

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

April 14, 2020

Notice is hereby given that the Annual Meeting of Stockholders (the “Meeting”) of Telkonet, Inc., a Utah corporation (the “Company”), will be held on May 28, 2020 at 1:00 p.m., local time, at the offices of Telkonet, Inc., 20800 Swenson Dr., Suite 175, Waukesha, WI 53186 for the following purposes:

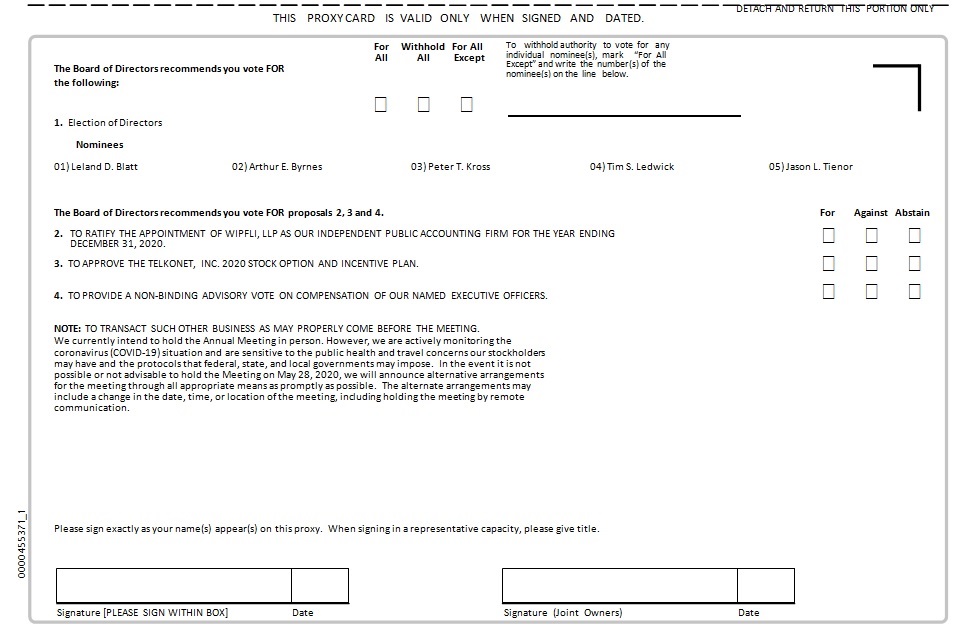

| 1. | To elect five (5) directors to the Company’s Board of Directors, each to serve until the next Annual Meeting of Stockholders and until his successor has been elected and qualified, or until his earlier death, resignation, disqualification, or removal; | |

| 2. | To ratify the appointment of Wipfli LLP as our independent registered public accounting firm for the year ending December 31, 2020; | |

|

3. 4. 5. |

To approve the Telkonet, Inc. 2020 Stock Option and Incentive Plan (the “2020 Plan”) To provide a non-binding advisory approval of the compensation of our named executive officers; and To transact such other business as may properly come before the Meeting. |

Only holders of record of the Company’s common stock, par value $0.001 per share, the Company’s Series A Preferred Stock, par value $0.001 per share, and the Company’s Series B Preferred Stock, par value $0.001 per share, at the close of business on March 31, 2020, the record date, are entitled to notice of and to vote at the Meeting or any adjournment or postponement thereof.

Unless you attend the meeting and vote your shares as discussed below, your shares will not be voted with respect to the election of directors, the non-binding advisory approval of the compensation of our named executive officers, and the 2020 Plan if you hold your shares in street name and have not provided instructions to your broker, bank, or other nominee. We strongly encourage you to submit your voting instruction card and exercise your right to vote as a stockholder.

Your vote is important. Even if you plan to attend the Meeting in person, the Company requests that you sign and return the enclosed proxy card, or vote by telephone or over the Internet as instructed in these materials, as promptly as possible to ensure that your shares will be represented at the Meeting if you are unable to attend. If you sign, date and mail your proxy card without indicating how you wish to vote, your proxy will be counted as a vote “FOR” each of the nominees for director, “FOR” the ratification of Wipfli LLP as our independent registered public accounting firm for the year ending December 31, 2020, “FOR” the approval of the 2020 Plan, “FOR” the non-binding advisory approval of the compensation of our named executive officers, and in the discretion of the proxies on any other matter which may properly come before the Meeting. If you do attend the Meeting and wish to vote in person, you may withdraw your proxy and vote in person. Please note, however, that if your shares are held of record by a broker, bank, or other nominee and you wish to vote at the Meeting, you must obtain from the record holder a proxy issued in your name.

We currently intend to hold the Meeting in person. However, we are actively monitoring the coronavirus (COVID-19) situation and are sensitive to the public health and travel concerns our stockholders may have and the protocols that federal, state, and local governments may impose. In the event it is not possible or not advisable to hold the Meeting on May 28, 2020, we will announce alternative arrangements for the meeting through all appropriate means as promptly as possible. The alternate arrangements may include a change in the date, time, or location of the meeting, including holding the meeting by remote communication

| By order of the Board of Directors, | |

| /s/ Richard E. Mushrush | |

| Richard E. Mushrush | |

| Secretary |

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” EACH OF THE NOMINEES FOR DIRECTOR, “FOR” PROPOSALS 2, 3, and 4.

YOU CAN VOTE IN ONE OF FOUR WAYS:

| (1) | Visit the website noted on your proxy card or notice of internet availability of proxy materials to vote via the Internet; |

| (2) | Vote by telephone at the number noted on your proxy card or notice of internet availability of proxy materials; |

| (3) |

Sign, date and return your proxy card in the enclosed envelope to vote by mail; OR | |

| (4) |

Attend the Meeting and vote in person. |

TELKONET, INC.

20800 Swenson Drive

Suite 175

Waukesha, WI 53186

414-302-2299

PROXY STATEMENT

This proxy statement contains information related to the Annual Meeting of Stockholders (the “Meeting”) of Telkonet, Inc., a Utah corporation, to be held on May 28, 2020 at 1:00 p.m., local time, at the offices of Telkonet, Inc., 20800 Swenson Dr. Suite 175, Waukesha, WI 53186, and at any postponements or adjournments thereof. In this proxy statement, “Telkonet”, the “Company”, “we”, “us” and “our” refer to Telkonet, Inc.

Under Securities and Exchange Commission rules, we are making this proxy statement and our Annual Report to Stockholders available on the Internet instead of mailing a printed copy of these materials to each stockholder. Stockholders who receive a Notice of Internet Availability of Proxy Materials (the “Notice”) by mail will not receive a printed copy of these materials other than as described below. Instead, the Notice contains instructions as to how stockholders may access and review all of the important information contained in the materials on the Internet, including how stockholders may submit proxies by telephone or over the Internet. The Notice and, as applicable, this proxy statement and our Annual Report on Form 10-K for the fiscal year ended December 31, 2019, which is being provided as our Annual Report to Stockholders, are being sent to stockholders on or about April 14, 2020.

If you received the Notice by mail and would prefer to receive a printed copy of our proxy materials, please follow the instructions for requesting printed copies included in the Notice.

Important Notice Regarding the Availability of Proxy Materials for

the Annual Meeting of Stockholders to Be Held on May 28, 2020.

This proxy statement and accompanying notice, proxy card and Annual Report on Form 10-K for the fiscal year ended December 31, 2019, are available on the following website at http://www.proxyvote.com.

VOTING AT THE ANNUAL MEETING

Revocability of Proxies

Any proxy given pursuant to this solicitation may be revoked by the person giving it at any time before it is voted. Attendance at the Meeting will not, in and of itself, revoke a proxy. Proxies may be revoked by:

| ● | Filing with the Secretary of Telkonet, at or before the taking of the vote at the Meeting, a written notice of revocation dated later than the proxy; | |

| ● | Voting again at a later date (but prior to the Meeting) on the Internet or by telephone; | |

| ● | Executing a later dated proxy relating to the same shares of capital stock and delivering it to the Secretary of Telkonet before the taking of the vote at the Meeting; or | |

| ● | Attending the Meeting and voting in person. |

Any written revocation or subsequent proxy should be sent so as to be delivered to Telkonet, Inc., 20800 Swenson Drive, Suite 175, Waukesha, WI 53186, Attention: Corporate Secretary, or hand delivered to the Secretary of Telkonet or his representative at or before the taking of the vote at the Meeting.

If the Meeting is postponed or adjourned, proxies given pursuant to this solicitation will be utilized at any subsequent reconvening of the Meeting, except for any proxies that previously have been revoked or withdrawn effectively, and notwithstanding that proxies may have been effectively voted on the same or any other matter previously.

| 1 |

Voting Rights

Only holders of record of our common stock, par value $0.001 per share (“common stock”), holders of record of our Series A Preferred Stock, par value $0.001 per share (“Series A Preferred Stock”), and holders of record of our Series B Preferred Stock, par value $0.001 per share (“Series B Preferred Stock”) at the close of business on March 31, 2020, the record date (the “Record Date”), are entitled to notice of and to vote at the Meeting, and at any postponements or adjournments thereof. Holders of our Series A Preferred Stock and holders of our Series B Preferred Stock will each vote on an as-converted basis together with holders of our common stock as a single class in connection with each of the proposals in this proxy statement. Each share of common stock is entitled to one vote on all matters to be voted upon at the Meeting; each share of Series A Preferred Stock is entitled to 13,774 votes on all matters to be voted upon at the Meeting; and each share of Series B Preferred Stock is entitled to 38,461 votes on all matters to be voted on at the Meeting. At least a majority of our shares outstanding on the Record Date and entitled to vote (counting our Series A Preferred Stock and Series B Preferred Stock each on an as-converted basis, representing an aggregate of 4,548,162 shares of common stock for such purposes) must be represented at the Meeting, either in person or by proxy, in order to constitute a quorum for the transaction of business. Abstentions and broker non-votes will be counted for purposes of determining the presence or absence of a quorum. Broker non-votes occur when a nominee holding shares for a beneficial owner does not have discretionary voting power on a matter and has not received instructions from the beneficial owner.

How to Vote; How Proxies Work

Our Board of Directors (the “Board of Directors” or the “Board”) is asking for your proxy. Whether or not you plan to attend the Meeting, we urge you to vote by proxy as you can always change your vote at the Meeting. Please provide your proxy by voting on the Internet or by telephone, or complete, date and sign the enclosed proxy card and return it at your earliest convenience. We will bear the costs incidental to the solicitation and obtaining of proxies, including the costs of reimbursing banks, brokers and other nominees for forwarding proxy materials to beneficial owners of our capital stock. Proxies may be solicited by our officers and employees, without extra compensation, in person, by telephone, and by other methods of communication.

At the Meeting, and at any postponements and adjournments thereof, all shares entitled to vote and represented by properly executed proxies received prior to the Meeting and not revoked will be voted as instructed on those proxies. If no instructions are indicated on a properly executed proxy, the shares will be voted “FOR” each of the nominees for director, “FOR” the ratification of Wipfli LLP as our independent registered public accounting firm for the year ending December 31, 2020, “FOR” the approval of the Telkonet, Inc. 2020 Stock Option and Incentive Plan (the “2020 Plan”), “FOR” the non-binding advisory approval of the compensation of our named executive officers, and in the discretion of the proxies on any other matter which may properly come before the Meeting.

Questions and Answers

Q. What am I voting on?

You are voting on four proposals:

| 2 |

Proposal No.1: For the election of five (5) nominees to our Board of Directors, each to serve until the next Annual Meeting of Stockholders and until his successor has been elected and qualified, or until his earlier death, resignation, disqualification, or removal.

Proposal No.2: For ratification of the selection of Wipfli LLP as our independent registered public accounting firm for the year ending December 31, 2020.

Proposal No.3: To approve the Telkonet, Inc. 2020 Stock Option and Incentive Plan (the “2020 Plan”).

Proposal No.4: To provide a non-binding advisory approval of the compensation of our named executive officers.

Q. Who is entitled to vote?

Only holders of record of our common stock and holders of record of our Series A Preferred Stock and Series B Preferred Stock at the close of business on March 31, 2020, the Record Date, are entitled to vote shares held by such stockholders on that date at the Meeting.

Q. How do I vote?

Vote by Internet: Visit the website noted on your proxy card or the Notice to vote via the Internet.

Vote By Telephone: Call the number noted on your proxy card or Notice to vote by telephone.

Vote By Mail: Sign and date the proxy card you receive and return it in the enclosed stamped, self-addressed envelope.

Vote in Person: Sign and date the proxy you receive and return it in person at the Meeting. If your shares are held in the name of a bank, broker or other holder of record (i.e., in “street name”), you will receive instructions from the holder of record that you must follow in order for your shares to be voted. Internet voting will be offered to stockholders owning shares through most banks and brokers.

Q. How many votes do I have?

On each matter to be voted upon, each share of common stock is entitled to one vote, each share of Series A Preferred Stock is entitled to 13,774 votes and each share of Series B Preferred Stock is entitled to 38,461 votes.

Q. How many shares were outstanding on the Record Date?

At the close of business on March 31, 2020, the Record Date, there were 140,859,497 shares outstanding (counting our Series A Preferred Stock and our Series B Preferred Stock on an as-converted basis, representing an aggregate of 4,548,162 shares of common stock for such purposes).

Q. What is a “quorum” for purposes of the Meeting?

In order to conduct business at the Meeting, a quorum of stockholders is necessary to hold a valid meeting. Holders of our Series A Preferred Stock and holders of our Series B Preferred Stock will each vote on an as-converted basis together with holders of our common stock as a single class in connection with each of the proposals contained in this proxy statement. At least a majority of our shares outstanding on the Record Date and entitled to vote (counting our Series A Preferred Stock on an as-converted basis and our Series B Preferred Stock on an as-converted basis, representing an aggregate of 4,548,162 shares of common stock for such purposes) must be represented at the Meeting, either in person or by proxy, in order to constitute a quorum for the transaction of business. At the close of business on the Record Date, there were 140,859,497 shares outstanding and entitled to vote (counting our Series A Preferred Stock on an as-converted basis and our Series B Preferred Stock on an as-converted basis, representing an aggregate of 4,548,162 shares of common stock for such purposes) and, accordingly, the presence, in person or by proxy, of at least 70,429,769 shares is necessary to meet the quorum requirement.

| 3 |

Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other nominee) or if you vote in person at the Meeting. Abstentions and broker non-votes will be counted towards the quorum requirement. If there is no quorum, the holders of a majority of shares present at the Meeting in person or represented by proxy may adjourn the Meeting to another date.

Q. Who is paying for this proxy solicitation?

The Company will pay for the entire cost of soliciting proxies, including the printing and filing of this proxy statement, the Notice, the proxy card and any additional information furnished to stockholders. In addition, our directors and employees may also solicit proxies in person, by telephone, or by other means of communication. Directors and employees will not be paid any additional compensation for soliciting proxies. We will also reimburse brokerage firms, banks and other agents for the reasonable out-of-pocket expenses they incur to forward proxy materials to beneficial owners.

Q. What if I return a proxy card but do not make specific choices?

All shares for which a proxy has been properly submitted and not revoked will be voted at the Meeting in accordance with your instructions. If you sign your proxy card but do not give voting instructions, the shares represented by that proxy will be voted in the discretion of the proxies. The proxies intend to vote in favor of the election of each director nominee, in favor of Proposal Nos 2, 3, and 4.

If any other matter is properly presented at the Meeting, your proxy (one of the individuals named on your proxy card) will vote your shares using his best judgment.

Q. Can I access the proxy materials electronically?

This proxy statement, the proxy card, and our Annual Report on Form 10-K for the period ended December 31, 2019 are available on the following website at http://www.proxyvote.com.

Q. Can I change my vote or revoke my proxy?

Yes. You may change your vote or revoke your proxy at any time before the proxy is exercised. Proxies may be revoked by:

| ● | Filing with the Secretary of Telkonet, at or before the taking of the vote at the Meeting, a written notice of revocation dated later than the proxy; | |

| ● | Voting again at a later date (but prior to the Meeting) on the Internet or by telephone; | |

| ● | Executing a later dated proxy relating to the same shares of capital stock and delivering it to the Secretary of Telkonet, including by facsimile, before the taking of the vote at the Meeting; or | |

| ● | Attending the Meeting and voting in person. |

Any written revocation or subsequent proxy should be sent so as to be delivered to Telkonet, Inc., 20800 Swenson Drive, Suite 175, Waukesha, WI 53186, Attention: Corporate Secretary, or hand delivered to the Secretary of Telkonet or his representative at or before the taking of the vote at the Meeting. Attendance at the Meeting will not have the effect of revoking a proxy unless you give written notice of revocation to the Corporate Secretary before the proxy is exercised or you vote by written ballot at the Meeting.

| 4 |

Q. What is the process for admission to the Meeting?

If you are a record owner of your shares (i.e., your shares are held in your name), you must show government issued identification. Your name will be verified against the stockholder list. If you hold your shares through a bank, broker or other nominee, you must also bring a copy of your latest bank or broker statement showing your ownership of your shares as of the Record Date.

Q. How many votes are required to approve matters to be presented?

Each of our Series A Preferred Stock and Series B Preferred Stock is entitled to vote on Proposal Nos. 1, 2, 3, and 4 on an as-converted basis with our common stock as a single class. Each share of common stock is entitled to one vote; each share of Series A Preferred Stock is entitled to 13,774 votes on each of the proposals contained in this proxy statement; and each share of Series B Preferred Stock is entitled to 38,461 votes on each of the proposals contained in this proxy statement.

We have described the vote necessary for each Proposal in the description of that Proposal. Voting ceases when the polls are closed at the Annual Meeting. In determining whether a majority of the shares of the common stock (counting our Series A Preferred Stock and Series B Preferred Stock each on an as-converted basis) present at the Meeting in person or by proxy have been affirmatively voted for a particular proposal, except in the election of directors, the affirmative votes for the proposal are compared to the votes against the proposal plus the abstentions from voting on the proposal. You may abstain from voting on any proposal. Except in the election of directors, abstentions from voting are not considered as votes affirmatively cast and therefore will have the effect of a vote against a proposal. With regard to the election of directors, abstentions will be excluded entirely from the vote and will have no effect.

Q. How will my shares held in street name be voted if I do not provide voting instructions?

If you are a beneficial owner of shares held in street name and do not provide the organization that holds your shares with specific voting instructions, under the rules of various national and regional securities exchanges, the organization that holds your shares may generally vote on routine matters but cannot vote on non-routine matters, including the election of directors and proposals relating to executive compensation. Accordingly, if you are a street-name holder and do not provide instructions to your broker on Proposal No. 1, Proposal No. 3, or Proposal No. 4 your broker may not vote your shares on such proposals. If you hold your shares in street name and have not provided instructions to your broker; thus we strongly encourage you to submit your voting instruction card and exercise your right to vote as a stockholder.

Q. What are the recommendations of the Board of Directors?

The Board of Directors unanimously recommends that the stockholders vote:

| · | FOR each of the nominees for director listed in Proposal No. 1; | |

| · | FOR ratification of the appointment of Wipfli LLP as our independent registered public accounting firm for the year ending December 31, 2020 in Proposal No. 2; | |

| · | FOR the approval of the Telkonet, Inc. 2020 Stock Option and Incentive Plan (the “2020 Plan”) in Proposal No. 3; and | |

| · | FOR non-binding advisory approval of the compensation of our Named Executive Officers (as defined below) in Proposal No. 4. |

With respect to any other matter that properly comes before the Meeting, the proxies may use their discretion to determine how to vote.

| 5 |

PROPOSAL No. 1

ELECTION OF DIRECTORS

The first proposal to be voted on at the Meeting is the election of five (5) directors. Upon the Nominating Committee’s recommendation, the Board has nominated all of the current directors for re-election to the Board. Each of the nominees has consented to serve as a nominee, to be named as a nominee in this Proxy Statement, and to serve as a director if elected. Telkonet’s bylaws establish the number of directors at not less than three (3) members. Pursuant to the bylaws, the Board of Directors may increase or decrease the number of members of the Board of Directors. The Board of Directors has established the number of directors at five (5). At the Meeting, the shares represented by properly executed proxies, unless otherwise specified, will be voted for the election of the five (5) nominees named herein, each to serve until the next Annual Meeting of Stockholders and until his successor is duly elected and qualified, or until his earlier death, resignation, disqualification, or removal. If for any reason any nominee is not a candidate when the election occurs (which is not expected), the Board of Directors expects that proxies will be voted for the election of a substitute nominee designated by the Board of Directors.

The following information is furnished concerning each nominee for election as a director.

Nominees for Election at the Annual Meeting

| Director Name | Age | Position With Telkonet | Director Since | |||

| Arthur E. Byrnes | 75 | Chairman of the Board (1) | 2016 | |||

| Peter T. Kross | 78 | Director (2) (3) | 2016 | |||

| Leland D. Blatt | 72 | Director (3) | 2016 | |||

| Tim S. Ledwick | 62 | Director (1) (2) (3) | 2012 | |||

| Jason L. Tienor | 45 | Director, President, and Chief Executive Officer | 2009 |

| (1) | Member of the Audit Committee |

| (2) | Member of the Compensation Committee |

| (3) | Member of the Nominating Committee |

ARTHUR E. BYRNES, Chairman of the Board, since 1971, Mr. Byrnes has worked at the Deltec organization in various capacities, with a focus on analysis and investment management in the global arena. Currently, he is the Senior Managing Director (and co-controlling shareholder) of Deltec Asset Management LLC, an investment advisory firm. Deltec Asset Management manages approximately nine hundred million dollars in emerging market debt and equities, high yield bonds, distressed debt and U.S. special situation equities. Mr. Byrnes served as a board member (1993 to 1998) and chairman of the board (1997 to 1998) of Dravo Corporation, a New York Stock Exchange Listed lime company, until the company was sold in 1998. We believe Mr. Byrne’s extensive executive and board chairman experience qualify him to sit on our board.

PETER T. KROSS, Director, Mr. Kross graduated from St. Lawrence University in 1963 with a BA in economics, and worked in public accounting at Lybrand Ross Bros., now PricewaterhouseCoopers, before joining Reynolds & Co. in 1968 to work in the brokerage business. He has worked in the brokerage business ever since. Specifically, since September 2012, Mr. Kross has been a Senior Vice President at L.M. Kohn & Company, a registered broker-dealer. He was also an independent investment adviser affiliated with D.B. French & Co. LLC, an investment firm, from July 2012 to September 2012. From May 2002 to July 2012, Mr. Kross was employed as a broker at Leonard & Co., a registered broker-dealer. He was also the managing partner of Kross LaSalle Partners (later becoming LaSalle Financial Partners), which was an activist limited partnership investing in smaller Midwestern banks that sought board representation when it believed such representation might help maximize shareholder value. We believe Mr. Koss’s qualifications to sit on our Board include his background in public accounting as well as his executive experience.

| 6 |

LELAND D. BLATT, Director, Mr. Blatt has acted as a co-manager of a family investment office, Ibis Investment Company, for over 18 years. He is also a partner and co-owner of a real estate company focused on office buildings in Michigan, Florida and Maryland. Over the past 20 years, Mr. Blatt has been involved in pro bono non-profit work, serving on committees and boards. We believe Mr. Blatt’s extensive board membership experience qualify him to sit on our board.

TIM S. LEDWICK, Director, Mr. Ledwick has served as a director since April 2012. Mr. Ledwick has over 20 years’ experience as a CFO in both public and private companies. Mr. Ledwick is currently the Chief Financial Officer of Syft, a private equity-backed company that provides software solutions and services to hospitals focused on reducing costs through superior inventory management practices. From 2007 to 2011, Mr. Ledwick provided CFO consulting services to a variety of companies including a $150 million services firm. Mr. Ledwick currently serves on the Board of Directors at Spherix Incorporated (SPEX), a NASDAQ listed intellectual property company, and is the Chair of the Audit Committee of Spherix Incorporated. Mr. Ledwick is a member of the Connecticut Society of Certified Public Accountants and received his BBA in Accounting from The George Washington University and his MS in Finance from Fairfield University. We believe Mr. Ledwick’s qualifications to sit on our Board include his background in public accounting as well as his financial executive experience.

JASON L. TIENOR, Mr. Tienor has served as Telkonet’s President and Chief Executive Officer since December 2007, and prior to that served as Chief Operating Officer from August 2007 until December 2007. He was appointed to Telkonet’s Board in November 2009. Mr. Tienor cofounded EthoStream, LLC in 2002 and operated as President and CEO of the company through its acquisition by Telkonet in 2007. Prior to EthoStream, Mr. Tienor also cofounded and operated a technology consulting business specializing in Internet technologies. Mr. Tienor currently acts as a mentor and advisor for numerous organizations and serves on a number of corporate and association Boards. Mr. Tienor is recognized as an authority in the Automation and Clean Technology space and has appeared numerous times for keynote and interview presentations including the University of Wisconsin Oshkosh Center for Entrepreneurship and Innovation, Bloomberg Television, Business Journal and other magazine, television and radio interviews. Mr. Tienor received a Bachelor of Business Administration in both Management Information Systems (MIS) and Marketing from the University of Wisconsin – Oshkosh and a Master of Business Administration from Marquette University. We believe Mr. Tienor’s qualifications to sit on our Board of Directors include: his extensive experience in business and executive management; his broad credentials in the Company’s technology fields and the leadership he has provided to multiple businesses including Telkonet, first as Chief Operating Officer and then as President and Chief Executive Officer.

Required Vote

Directors are elected by a plurality of the votes cast by holders of shares of our common stock, our Series A Preferred Stock and our Series B Preferred Stock, voting together as a single class on an as-converted basis, entitled to vote at the Meeting, either in person or by proxy. Votes may be cast in favor of a nominee or withheld. Because directors are elected by plurality, abstentions from voting and broker non-votes will be excluded from the vote on this proposal and will have no effect on its outcome. If a quorum is present at the Meeting, the five nominees receiving the greatest number of votes will be elected. For beneficial owners of shares held in street name, brokers are prohibited from giving proxies to vote on the election of directors unless the beneficial owner has given voting instructions as to each director. This means that if your broker is the record holder of your shares you must give voting instructions to your broker if you want your broker to vote your shares for the election of directors.

THE BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS

VOTE “FOR” THE ELECTION OF EACH NOMINEE

| 7 |

PROPOSAL No. 2

RATIFICATION OF APPOINTMENT OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee is responsible for recommending to the Board of Directors the selection of the independent registered public accounting firm retained to audit the Company’s consolidated financial statements for each fiscal year. In 2019, the Audit Committee conducted a comprehensive request for proposal (“RFP”) process, which resulted in the Audit Committee selecting Wipfli, LLP (“Wipfli”) as the new independent registered public accounting firm for 2020. BDO USA, LLP (“BDO”) continued to serve as the Company’s independent registered public accounting firm for the year ended December 31, 2019, having served continuously in that role since 2013.

During the RFP process, the Audit Committee evaluated the proposals of the independent registered public accounting firms and considered multiple factors, including audit quality, the professional qualifications of the firm, the professional qualifications of the proposed lead engagement partner and the primary engagement team that would serve the Company, the benefits of tenure versus fresh perspective, potential transition risks, technological capabilities, and the appropriateness of fees relative to both efficiency and audit quality. On March 31, 2020, after careful consideration of each firm’s qualifications, the Audit Committee approved the engagement of Wipfli as the Company’s independent registered public accounting firm for the Company’s fiscal year ending December 31, 2020.

Based on the Audit Committee’s recommendation, the Board of Directors has directed that management submit the selection of Wipfli for ratification by the stockholders at the Meeting. The Board of Directors believes that the engagement of Wipfli as the Company’s independent registered public accounting firm for 2020 is in the best interest of the Company and its stockholders. Representatives of neither BDO nor Wipfli are expected to be present at the Meeting. However, if any representatives do attend, they will have an opportunity to make a statement, should the representative desire to do so, and will be available to respond to appropriate questions.

Stockholder ratification of the selection of Wipfli as the Company’s independent registered public accounting firm is not required. However, the Board of Directors is submitting the selection of Wipfli to the stockholders for ratification as a matter of good corporate practice. If the stockholders do not ratify the selection, the Audit Committee will reconsider whether to retain the firm in future years. In such event, the Audit Committee may retain Wipfli, notwithstanding the fact that the stockholders did not ratify the selection, or select another accounting firm without re-submitting the matter to the stockholders. Even if the selection is ratified, the Audit Committee reserves the right, in its discretion, to select a different accounting firm at any time during the year if it determines that such a change would be in the best interests of the Company and its stockholders. Disclosure of Additional Information Regarding Change of Independent Registered Public Accounting Firms

BDO was dismissed as the Company’s independent registered public accounting firm effective as of March 30, 2020, following the completion of BDO’s audit of the consolidated financial statements of the Company as of and for the year ending December 31, 2019, and the issuance of their report thereon.

BDO’s audit reports on the Company’s consolidated financial statements for each of the fiscal years ended December 31, 2019 and 2018 did not contain any adverse opinion or disclaimer of opinion, nor were they qualified or modified as to uncertainty, audit scope, or accounting principles, except as follows:

BDO’s report on (i) the consolidated financial statements of the Company as of and for the years ended December 31, 2019 and 2018, each contained separate explanatory paragraphs regarding substantial doubt about the Company’s ability to continue as a going concern, (ii) the consolidated financial statements of the Company as of and for the year ended December 31, 2019 contained a separate paragraph stating that as discussed in Notes B and M to the consolidated financial statements, the Company changed its method of accounting for leases in 2019 due to the adoption of Accounting Standards Codification Topic 842 – Leases, and (iii) the consolidated financial statements of the Company as of and for the year ended December 31, 2018 contained a separate paragraph stating that as discussed in Notes A, B and C to the consolidated financial statements, the Company changed its method of accounting for revenue from contracts with customers in the year 2018 due to the adoption of Accounting Standards Codification Topic 606, Revenue from Contracts with Customers.

| 8 |

During the fiscal years ended December 31, 2019 and 2018, and the subsequent interim period through March 30, 2020, there were no disagreements within the meaning of Item 304(a)(1)(iv) of Regulation S-K between the Company and BDO on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreements, if not resolved to BDO’s satisfaction, would have caused BDO to make reference to the subject matter of the disagreement(s) in connection with its reports on the Company’s consolidated financial statements for such years.

During the years ended December 31, 2019 and 2018, and the subsequent interim period through March 30, 2020, there were no “reportable events” within the meaning of Item 304(a)(1)(v) of Regulation S-K, except as follows:

In connection with BDO’s audit of the Company's consolidated financial statements for the fiscal years ended December 31, 2019 and 2018, BDO advised the Company that they had identified material weaknesses in the Company’s internal control over financial reporting relating to not having adequate financial reporting and close process controls, a lack segregation of duties, not having effective controls over the recording of revenue recognition contracts, and not having adequate processes and procedures for the Company’s IT general control environment. These material weaknesses are further described in Part II, Item 9A. “Controls and Procedures” of the Annual Reports on Form 10-K for each of the fiscal years ended December 31, 2019 and 2018, filed with the Securities and Exchange Commission on March 30, 2020 and April 1, 2019, respectively. The subject matter of these internal control deficiencies was discussed by the Audit Committee of the Board of Directors of the Company with BDO. The Company has authorized BDO to respond fully to the inquiries of the successor independent registered public accounting firm concerning the internal control deficiencies.

During the fiscal years ended December 31, 2019 and 2018 and the subsequent interim period through March 30, 2020, neither the Company nor anyone on its behalf has consulted with Wipfli regarding: (i) the application of accounting principles to a specific transaction, either completed or proposed, or the type of audit opinion that might be rendered on the Company's financial statements, and neither a written report nor oral advice was provided to the Company that Wipfli concluded was an important factor considered by the Company in reaching a decision as to any accounting, auditing, or financial reporting issue; (ii) any matter that was the subject of a disagreement within the meaning of Item 304(a)(1)(iv) of Regulation S-K and the related instructions; or (iii) any “reportable event” within the meaning of Item 304(a)(1)(v) of Regulation S-K.

The Company filed a Form 8-K with the SEC disclosing this change in its independent registered public accounting firm on April 2, 2020.

Independent Registered Public Accounting Firm Fees and Services

The following table sets forth fees billed, or expected to be billed, to the Company by BDO for the fiscal years ended December 31, 2019 and 2018.

December 31, 2019 | December 31, 2018 | |||||||

| Audit Fees (1) | $ | 279,311 | $ | 264,248 | ||||

| Tax Fees (2) | 33,150 | 36,300 | ||||||

| Total Fees | $ | 312,461 | $ | 300,548 | ||||

| (1) | Audit fees consist of fees billed for professional services rendered for the audit of the Company’s consolidated financial statements and review of the interim consolidated financial statements included in quarterly reports and services that are normally provided by BDO in connection with statutory and regulatory filings or engagements. Included in the fiscal year ended December 31, 2018 total, was approximately $73,500 in incremental audit fees not included in the 2018 audit engagement letter. |

| (2) | Tax fees consist of fees billed for professional services for tax return preparation and filing, compliance, advice and planning. The tax fees relate to federal and state income tax reporting requirements. |

| 9 |

Prior to the Company’s engagement of its independent registered public accounting firm, such engagement is approved by the Company’s Audit Committee. The services provided under this engagement may include audit services, audit-related services, tax services and other services. Pre-approval is generally provided for up to one year and any pre-approval is detailed as to the particular service or category of services and is generally subject to a specific budget. Pursuant to the Audit Committee Charter, the independent registered public accounting firm and management are required to report to the Company’s Audit Committee at least quarterly regarding the extent of services provided by the independent registered public accounting firm in accordance with this pre-approval, and the fees for the services performed to date. The Audit Committee may also pre-approve particular services on a case-by-case basis. All audit fees, audit-related fees, tax fees and other fees incurred by the Company for the year ended December 31, 2019 were approved by the Company’s Audit Committee.

Required Vote

The affirmative vote of a majority of the shares of the common stock (counting our Series A Preferred Stock and Series B Preferred Stock each on an as-converted basis) present at the Meeting in person or by proxy is required to ratify the appointment of Wipfli as the Company’s independent registered public accounting firm. For beneficial owners of shares held in street name, brokers have discretion and may give proxies on Proposal No. 2 whether or not they receive instructions from the beneficial owners of those shares.

THE BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS

VOTE “FOR” THE APPROVAL OF THIS PROPOSAL NO. 2

| 10 |

PROPOSAL No. 3

APPROVAL OF THE TELKONET, INC. 2020 STOCK OPTION AND INCENTIVE PLAN

Our Board of Directors believes that stock options and other stock-based incentive awards can play an important role in the success of the Company by encouraging and enabling the employees, officers, non-employee directors and other key persons of the Company and its subsidiaries upon whose judgment, initiative and efforts the Company largely depends for the successful conduct of its business to acquire a proprietary interest in the Company. Our Board of Directors anticipates that providing such persons with a direct stake in the Company will assure a closer identification of the interests of such individuals with those of the Company and its stockholders, thereby stimulating their efforts on the Company’s behalf and strengthening their desire to remain with the Company.

On February 24, 2020 the Board of Directors, upon the recommendation of the Compensation Committee of the Board of Directors (the “Compensation Committee”), adopted the Telkonet, Inc. 2020 Stock Option and Incentive Plan (the “2020 Plan”), subject to the approval of the Company’s stockholders. The 2020 Plan will replace the 2010 Stock Option and Incentive Plan (the “2010 Plan”), which is expiring on November 17, 2020. The 2020 Plan provides flexibility to the Board of Directors or the Compensation Committee to use various equity-based incentive awards as compensation tools to motivate the Company’s workforce. A copy of the 2020 Plan is attached as Annex A to this proxy statement and is incorporated herein by reference.

Summary of Material Features

The material features of the 2020 Plan as proposed to be approved are:

| ● | The maximum number of shares of common stock to be issued under the 2020 Plan is 10,000,000 shares; | |

| ● | The award of stock options (both incentive and non-qualified options), stock appreciation rights, restricted stock, restricted stock units, unrestricted stock, performance shares, dividend equivalent rights and cash-based awards is permitted; | |

| ● | Minimum vesting periods are required for grants of restricted stock, restricted stock units and performance share awards; and | |

| ● | The term of the 2020 Plan will expire on the tenth anniversary of the date it is approved by the stockholders. |

Summary of the 2020 Plan

The following description of certain features of the 2020 Plan is intended to be a summary only. The summary is qualified in its entirety by the full text of the 2020 Plan that is attached hereto as Annex A.

Plan Administration. The 2020 Plan is administered by the Board of Directors or the Compensation Committee (the “Administrator”). The Administrator has full power to select, from among the individuals eligible for awards, the individuals to whom awards will be granted, to make any combination of awards to participants, and to determine the specific terms and conditions of each award, subject to the provisions of the 2020 Plan; provided, however, that the amount, timing and terms of grants of awards to non-employee directors will be determined by the Compensation Committee. The Administrator may delegate to our Chief Executive Officer the authority to grant stock options to employees who are not subject to the reporting and other provisions of Section 16 of the Exchange Act, subject to certain limitations and guidelines.

Eligibility. Persons eligible to participate in the 2020 Plan will be those full or part-time officers, employees, non-employee directors and other key persons (including consultants and prospective officers) of the Company and its subsidiaries as selected from time to time by the Administrator in its discretion. Approximately forty-two (42) individuals are currently eligible to participate in the 2020 Plan, which includes three officers, thirty-five (35) employees who are not officers, and four non-employee directors.

Shares. The shares we issue under the 2020 Plan will be authorized but unissued shares or shares that we reacquire. The shares of common stock underlying any awards that are forfeited, canceled, held back upon exercise or settlement of an award to satisfy the exercise price or tax withholding, reacquired by the Company prior to vesting, satisfied without any issuance of stock, expire or are otherwise terminated (other than by exercise) under the 2020 Plan are added back to the shares of common stock available for issuance under the 2020 Plan.

| 11 |

Plan Limits. The maximum award of incentive stock options granted to any one individual will not exceed 1,500,000 shares of common stock (subject to adjustment for stock splits and similar events).

Effect of Awards. For purposes of determining the number of shares of common stock available for issuance under the 2020 Plan, the grant of any full-value Award (i.e., an Award other than an Option or a Stock Appreciation Right), Option, or Stock Appreciation Right is deemed, for purposes of determining the number of shares of Stock available for issuance under the 2020 Plan, as an Award for one share of Stock for each such share of Stock actually subject to the Award.

Performance-Based Awards. The 2020 Plan provides that the Administrator may require that the vesting of such awards be conditioned on the satisfaction of performance criteria, including, but not limited to the following: (1) earnings before interest, taxes, depreciation and amortization; (2) net income (loss) (either before or after interest, taxes, depreciation and/or amortization); (3) changes in the market price of the stock; (4) economic value-added; (5) funds from operations or similar measures; (6) sales or revenue; (7) acquisitions or strategic transactions; (8) product development or quality; (9) operating income (loss); (10) cash flow (including, but not limited to, operating cash flow and free cash flow); (11) return on capital, assets, equity, or investment; (12) stockholder returns; (13) return on sales; (14) gross or net profit levels; (15) productivity; (16) expenses; (17) margins; (18) operating efficiency; (19) customer satisfaction; (20) working capital; (21) earnings (loss) per share of common stock; (22) sales or market shares; and (23) number of customers, any of which may be measured either in absolute terms or as compared to any incremental increase or as compared to results of a peer group.

Stock Options. The 2020 Plan permits the granting of (1) options to purchase common stock intended to qualify as incentive stock options under Section 422 of the Code and (2) options that do not so qualify. Options granted under the 2020 Plan will be non-qualified options if they fail to qualify as incentive options or exceed the annual limit on incentive stock options. Incentive stock options may only be granted to employees of the Company and its subsidiaries. Non-qualified options may be granted to any persons eligible to receive incentive options and to non-employee directors and key persons. The option exercise price of each option will be determined by the Administrator but may not be less than 100% of the fair market value of the common stock on the date of grant. The exercise price of an option may not be reduced after the date of the option grant, other than to appropriately reflect changes in our capital structure.

The term of each option will be fixed by the Administrator and may not exceed ten years from the date of grant. The Administrator will determine at what time or times each option may be exercised. Options may be made exercisable in installments and the exercisability of options may be accelerated by the Administrator. In general, unless otherwise permitted by the Administrator, no option granted under the 2020 Plan is transferable by the optionee other than by will or by the laws of descent and distribution, and options may be exercised during the optionee’s lifetime only by the optionee, or by the optionee’s legal representative or guardian in the case of the optionee’s incapacity.

Upon exercise of options, the option exercise price must be paid in full either in cash, by certified or bank check or other instrument acceptable to the Administrator or by delivery (or attestation to the ownership) of shares of common stock that are beneficially owned by the optionee for at least six months or were purchased in the open market. Subject to applicable law, the exercise price may also be delivered to the Company by a broker pursuant to irrevocable instructions to the broker from the optionee. In addition, the Administrator may permit non-qualified options to be exercised using a net exercise feature which reduces the number of shares issued to the optionee by the number of shares with a fair market value equal to the exercise price.

To qualify as incentive options, options must meet additional federal tax requirements, including a $100,000 limit on the value of shares subject to incentive options that first become exercisable by a participant in any one calendar year.

| 12 |

Stock Appreciation Rights. The Administrator may award stock appreciation rights subject to such conditions and restrictions as the Administrator may determine. Stock appreciation rights entitle the recipient to shares of common stock equal to the value of the appreciation in the stock price over the exercise price. The exercise price is the fair market value of the common stock on the date of grant.

Restricted Stock. The Administrator may award shares of common stock to participants subject to such conditions and restrictions as the Administrator may determine. These conditions and restrictions may include the achievement of certain performance goals (as summarized above) and/or continued employment with us through a specified restricted period. However, except in the case of retirement, death, disability or a change of control, in the event these awards granted to employees have a performance-based goal, the restriction period will be at least one year, and in the event these awards granted to employees have a time-based restriction, the restriction period will be at least three years, but vesting can occur incrementally over the three-year period.

Restricted Stock Units. The Administrator may award restricted stock units to any participants. Restricted stock units are ultimately payable in the form of shares of common stock and may be subject to such conditions and restrictions as the Administrator may determine. These conditions and restrictions may include the achievement of certain performance goals (as summarized above) and/or continued employment with the Company through a specified vesting period. However, except in the case of retirement, death, disability or a change of control, in the event these awards granted to employees have a performance-based goal, the restriction period will be at least one year, and in the event these awards granted to employees have a time-based restriction, the restriction period will be at least three years, but vesting can occur incrementally over the three-year period. In the Administrator’s sole discretion, it may permit a participant to make an advance election to receive a portion of his or her future cash compensation otherwise due in the form of a restricted stock unit award, subject to the participant’s compliance with the procedures established by the Administrator and requirements of Section 409A of the Code. During the deferral period, the deferred stock awards may be credited with dividend equivalent rights.

Unrestricted Stock Awards. The Administrator may also grant shares of common stock which are free from any restrictions under the 2020 Plan. Unrestricted stock may be granted to any participant in recognition of past services or other valid consideration and may be issued in lieu of cash compensation due to such participant.

Performance Share Awards. The Administrator may grant performance share awards to any participant which entitle the recipient to receive shares of common stock upon the achievement of certain performance goals (as summarized above) and such other conditions as the Administrator shall determine. Except in the case of retirement, death, disability or a change in control, these awards granted to employees will have a vesting period of at least one year.

Dividend Equivalent Rights. The Administrator may grant dividend equivalent rights to participants which entitle the recipient to receive credits for dividends that would be paid if the recipient had held specified shares of common stock. Dividend equivalent rights may be granted as a component of another award (other than a stock option or stock appreciation right) or as a freestanding award. Dividend equivalent rights may be settled in cash, shares of common stock or a combination thereof, in a single installment or installments, as specified in the award.

Cash-Based Awards. The Administrator may grant cash bonuses under the 2020 Plan to participants. The cash bonuses may be subject to the achievement of certain performance goals (as summarized above).

| 13 |

Change of Control Provisions. The 2020 Plan provides that upon the effectiveness of a “sale event” as defined in the 2020 Plan, except as otherwise provided by the Administrator in the award agreement, all stock options and stock appreciation rights will automatically become fully exercisable and the restrictions and conditions on all other awards with time-based conditions will automatically be deemed waived, unless the parties to the sale event agree that such awards will be assumed or continued by the successor entity. Awards with conditions and restrictions relating to the attainment of performance goals may become vested and non-forfeitable in connection with a sale event in the Committee’s discretion. In addition, in the case of a sale event in which the Company’s stockholders will receive cash consideration, the Company may make or provide for a cash payment to participants holding options and stock appreciation rights equal to the difference between the per share cash consideration and the exercise price of the options or stock appreciation rights.

Adjustments for Stock Dividends, Stock Splits, Etc. The 2020 Plan requires the Administrator to make appropriate adjustments to the number of shares of common stock that are subject to the 2020 Plan, to certain limits in the 2020 Plan, and to any outstanding awards to reflect stock dividends, stock splits, extraordinary cash dividends and similar events.

Tax Withholding. Participants in the 2020 Plan are responsible for the payment of any federal, state or local taxes that the Company is required by law to withhold upon the exercise of options or stock appreciation rights or vesting of other awards. Subject to approval by the Administrator, participants may elect to have the minimum tax withholding obligations satisfied by authorizing the Company to withhold shares of common stock to be issued pursuant to the exercise or vesting.

Amendments and Termination. The Board of Directors may at any time amend or discontinue the 2020 Plan and the Administrator may at any time amend or cancel any outstanding award for the purpose of satisfying changes in the law or for any other lawful purpose. However, no such action may adversely affect any rights under any outstanding award without the holder’s consent. To the extent required under the rules of any securities exchange or market system on which the Company’s stock is listed or to the extent determined by the Administrator to be required by the Internal Revenue Code of 1986, as amended (the “Code”) to ensure that incentive stock options granted under the 2020 Plan are qualified under Section 422 of the Code, Plan amendments shall be subject to approval by the Company stockholders entitled to vote at a meeting of stockholders.

Effective Date of 2020 Plan. The Board of Directors adopted the 2020 Plan on February 24, 2020, and the 2020 Plan becomes effective on the date it is approved by stockholders. Awards of incentive options may be granted under the 2020 Plan until the date that is 10 years following approval by the stockholders. No other awards may be granted under the 2020 Plan after the date that is 10 years from the date of stockholder approval. If the 2020 Plan is not approved by stockholders, the 2010 Plan will continue in effect until it expires, and awards may be granted thereunder, in accordance with its terms.

Federal Income Tax Consequences

Incentive Stock Options. An incentive stock option results in no taxable income to the optionee or deduction to the Company at the time it is granted or exercised. However, the excess of the fair market value of the shares acquired over the option price is an item of adjustment in computing the alternative minimum taxable income of the optionee. If the optionee holds the stock received as a result of an exercise of an incentive stock option for at least two years from the date of the grant and one year from the date of exercise, then the gain or loss realized on disposition of the stock is treated as a long-term capital gain or loss. If the shares are disposed of during this period (i.e., a “disqualifying disposition”), then the optionee will include in income, as compensation for the year of the disposition, an amount equal to the excess, if any, of the fair market value of the shares upon exercise of the option over the option price (or, if less, the excess of the amount realized upon disposition over the option price). The excess, if any, of the sale price over the fair market value on the date of exercise will be a capital gain. In such case, the Company will be entitled to a deduction, in the year of such a disposition, for the amount includible in the optionee's income as compensation. The optionee’s basis in the shares acquired upon exercise of an incentive stock option is equal to the option price paid, plus any amount includible in the optionee's income as a result of a disqualifying disposition.

| 14 |

Non-Qualified Stock Options. A non-qualified stock option results in no taxable income to the optionee or deduction to the Company at the time it is granted. An optionee exercising such an option will, at that time, realize taxable compensation in an amount equal to the difference between the option price and the then market value of the shares. A deduction for federal income tax purposes will be allowable to the Company in the year of exercise in an amount equal to the taxable compensation recognized by the optionee.

The optionee's basis in such shares is equal to the sum of the option price plus the amount includible in the optionee's income as compensation upon exercise. Any gain (or loss) upon subsequent disposition of the shares will be a long-term or short-term gain (or loss), depending upon the holding period of the shares.

If a non-qualified option is exercised by tendering previously owned shares of the Company's common stock in payment of the option price, then, instead of the treatment described above, the following generally will apply: a number of new shares equal to the number of previously owned shares tendered will be considered to have been received in a tax-free exchange; the optionee's basis and holding period for such number of new shares will be equal to the basis and holding period of the previously owned shares exchanged. The optionee will have compensation income equal to the fair market value on the date of exercise of the number of new shares received in excess of such number of exchanged shares; the optionee's basis in such excess shares will be equal to the amount of such compensation income; and the holding period in such excess shares will begin on the date of exercise.

Stock Appreciation Rights. Generally, the recipient of a stand-alone stock appreciation right will not recognize taxable income at the time the stand-alone stock appreciation right is granted. If an employee receives the appreciation inherent in the stock appreciation rights in cash, the cash will be taxed as ordinary income to the employee at the time it is received. If an employee receives the appreciation inherent in the stock appreciation rights in stock, the spread between the then current fair market value of the stock received and the base price will be taxed as ordinary income to the employee at the time the stock is received. In general, there will be no federal income tax deduction allowed to the Company upon the grant or termination of stock appreciation rights. However, upon the settlement of a stock appreciation right, the Company will be entitled to a deduction equal to the amount of ordinary income the recipient is required to recognize as a result of the settlement.

Other Awards. The current United States federal income tax consequences of other awards authorized under the 2020 Plan are generally in accordance with the following: (i) restricted stock is generally subject to ordinary income tax at the time the restrictions lapse, unless the recipient elects to accelerate recognition as of the date of grant; (ii) stock unit awards are generally subject to ordinary income tax at the time of payment; and (iii) unrestricted stock awards are generally subject to ordinary income tax at the time of grant. In each of the foregoing cases, the Company will generally be entitled to a corresponding federal income tax deduction at the same time the participant recognizes ordinary income.

Section 409A. Acceleration of income, additional taxes, and interest apply to nonqualified deferred compensation that is not compliant with Section 409A of the Internal Revenue Code. To be compliant with Section 409A rules with respect to the timing of elections to defer compensation, distribution events and funding must be satisfied. The terms of the 2020 Plan are intended to ensure that awards under it will not be subject to adverse tax consequences applicable to deferred compensation under Section 409A. However, there can be no assurance that additional taxation under Section 409A will be avoided in all cases.

Excess Parachute Payments. Section 280G of the Code limits the deduction that the employer may take for otherwise deductible compensation payable to certain individuals if the compensation constitutes an “excess parachute payment.” Excess parachute payments arise from payments made to disqualified individuals that are in the nature of compensation and are contingent on changes in ownership or control of the employer or certain affiliates. Accelerated vesting or payment of awards under the 2020 Plan upon a change in ownership or control of the employer or its affiliates could result in excess parachute payments. In addition to the deduction limitation, a disqualified individual receiving an excess parachute payment is subject to a 20% excise tax on the amount thereof.

| 15 |

THE ABOVE SUMMARY OF FEDERAL INCOME TAX CONSEQUENCES DOES NOT PURPORT TO BE COMPLETE. The preceding discussion is only a general summary of the federal income tax consequences concerning the 2020 Plan and does not address other taxes or state, local, or foreign taxes. It is based on current law and current Internal Revenue Service interpretations of the law, which are subject to change at any time. The Company has not requested an Internal Revenue Service ruling on any tax issues concerning the 2020 Plan and does not plan to do so. In some cases, existing Internal Revenue Service rulings and regulations do not provide complete guidance. Participants are advised to consult their own tax advisors regarding the tax effects of their participation in the 2020 Plan.

New Plan Benefits

The Administrator will determine any future awards made under the 2020 Plan. Therefore, the Company is unable to determine the awards that will be granted in the future under the 2020 Plan at this time. The Administrator has not made any grants of awards under the 2020 Plan that are conditioned upon stockholder approval of the 2020 Plan.

Equity Compensation Plan Information

The following table provides information concerning securities authorized for issuance pursuant to the 2010 Plan as of December 31, 2019.

.

| Number of securities to be issued upon exercise of outstanding options, warrants and rights | Weighted-average exercise price of outstanding options, warrants and rights | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) | ||||||||||

| (a) | (b) | (c) | ||||||||||

| Equity compensation plans approved by security holders | 3,599,793 | $ | 0.16 | 409,269 | ||||||||

| Equity compensation plans not approved by security holders | – | – | – | |||||||||

| Total | 3,599,793 | $ | 0.16 | 409,269 | ||||||||

Vote Required

The affirmative vote of a majority of the votes cast at the Meeting is required for the approval of the 2020 Plan. Because abstentions and broker non-votes are not considered to be votes cast, abstentions and broker non-votes will not have an effect on approval of the 2020 Plan.

Recommendation

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” THE APPROVAL OF THE TELKONET, INC. 2020 STOCK OPTION AND INCENTIVE PLAN.

| 16 |

PROPOSAL No. 4

NON-BINDING ADVISORY VOTE TO APPROVE

THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS

We are providing our stockholders the opportunity to vote to approve, on an advisory, non-binding basis, the compensation of our Named Executive Officers as disclosed in this proxy statement in accordance with the SEC's rules. This proposal, which is commonly referred to as "say-on-pay," is required by the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (the “Dodd-Frank Act”). The Company has decided to conduct advisory votes on our Named Executive Officers’ compensation annually until the next required advisory vote on the frequency of the advisory vote on the Company’s executive compensation in 2024. The named executive officers are the Company’s Chief Executive Officer (principal executive officer) and the other two most highly compensated executive officers as of December 31, 2019, which include Jason L. Tienor (President and Chief Executive Officer), Jeffrey J. Sobieski (Chief Technology Officer), and Richard E. Mushrush (Chief Financial Officer) (together, the “Named Executive Officers”).

Our executive compensation programs are designed to attract, motivate and retain our executive officers, who are critical to our success. Under these programs, our Named Executive Officers are rewarded for the achievement of our near-term and longer-term financial and strategic goals and for driving corporate financial performance and stability. The programs contain elements of cash and equity-based compensation and are designed to align the interests of our executives with those of our stockholders.

The section titled "Executive Compensation" of this proxy statement describes in detail our executive compensation programs and the decisions made by the Compensation Committee with respect to the fiscal year ended December 31, 2019. As we describe in this section of the proxy statement, our executive compensation program incorporates a pay-for-performance philosophy that supports our business strategy and aligns the interests of our executives with our shareholders. This link between compensation and the achievement of our near- and long-term business goals is intended to drive our performance over time.

Our Board of Directors is asking stockholders to approve a non-binding advisory vote on the following resolution:

RESOLVED, that the compensation paid to the Company's Named Executive Officers, as disclosed pursuant to the compensation disclosure rules of the Securities and Exchange Commission, including the disclosure under the section titled "Executive Compensation" of this proxy statement, the compensation tables and accompanying narrative disclosure, and any related material disclosed in this proxy statement, is hereby approved.

As an advisory vote, this proposal is not binding. The outcome of this advisory vote does not overrule any decision by the Company or the Board of Directors (or any committee thereof), create or imply any change to the fiduciary duties of the Company or the Board of Directors (or any committee thereof), or create or imply any additional fiduciary duties for the Company or the Board of Directors (or any committee thereof). However, our Compensation Committee and Board of Directors value the opinions expressed by our stockholders in their vote on this proposal and will consider the outcome of the vote when making future compensation decisions for the Named Executive Officers.

Required Vote

The affirmative vote of a majority of the shares of the common stock (counting our Series A Preferred Stock and Series B Preferred Stock each on an as-converted basis) present at the Meeting in person or by proxy is required to approve the resolution. For beneficial owners of shares held in street name, brokers are prohibited from giving proxies to vote on execution compensation matters unless the beneficial owner has given voting instructions as to each director. This means that if your broker is the record holder of your shares you must give voting instructions to your broker if you want your broker to vote your shares on this matter.

THE BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS

VOTE “FOR” THE APPROVAL OF THIS PROPOSAL NO. 4

| 17 |

INFORMATION ABOUT OUR BOARD OF DIRECTORS

Meetings of the Board and Committees

The Board of Directors held four meetings in 2019. Each member of the Board of Directors attended at least seventy-five percent (75%) of the meetings of the Board of Directors and the committees of which such director was a member. The Company has not established a formal policy requiring director attendance at all Board meetings, but the Company expects each director to attend such meetings, absent unusual circumstances. The Company also expects its directors to make an effort to attend the Annual Meeting of Stockholders. One member of the Company’s Board of Directors on the date of the 2019 Annual Meeting of Stockholders attended the meeting.

Code of Ethics

The Board has approved, and the Company has adopted, a Code of Ethics that applies to all directors, officers and employees of the Company. This Code of Ethics was included as an exhibit to the Company’s Form 10-KSB filed with the Securities and Exchange Commission on March 30, 2004.

Director Independence

The Board of Directors has determined that Messrs. Byrnes, Ledwick, Kross and Blatt are “independent” under the listing standards of the OTCQB Venture Market.

Board Leadership Structure and Role in Risk Oversight

Arthur E. Byrnes currently serves as Chairman of the Board of Directors while Jason L. Tienor serves as our President and Chief Executive Officer. The Board believes this structure is appropriate at this time because it allows the Company to benefit from the unique experience and skills of each of these individuals. Management of risk is the direct responsibility of the Company’s CEO and the senior leadership team. The Board has oversight responsibility, focusing on the adequacy of the Company’s enterprise risk management and risk mitigation processes.

Communications with the Board of Directors

Stockholders can communicate directly with the Board, with any Committee of the Board, or specified directors by writing to: The Board of Directors of the Company, at the Company’s principal business address or by calling at 414-302-2299. All communications will be reviewed by management and then forwarded to the appropriate director, directors, committee or to the entire Board of Directors.

Committees of the Board of Directors

The Board has an Audit Committee, a Compensation Committee and a Nominating Committee.

| 18 |

Nominating Committee

Mr. Blatt, Mr. Ledwick and Mr. Kross currently serve on the Company’s Nominating Committee, with Mr. Blatt serving as the Chairman of the committee. The written charter for the Nominating Committee is posted on the Company’s website at the following: https://ir.telkonet.com/governance-docs. The Nominating Committee did not hold any formal meetings in 2019, but reviewed the current directors and recommended all of the current directors for re-election to the Board.