Exhibit 99.6

CONVERTIBLE LOAN AGREEMENT

This Convertible Loan Agreement is entered into this 6th Day of January 2022 by and between:

| (1) | NOMADIX HOLDINGS LLC, a limited liability company duly organized and existing under the laws of Delaware (USA), with registered address at 1209 Orange St., New Castle, Wilmington, DE 19801, with File Number 7506079, represented by Ted HELVEY, acting in his capacity as manager with the right to individual signature; |

| Hereinafter referred to as the “Lender”; and |

| (2) | VDA Holding S.A., a joint stock company (société anonyme) incorporated and existing under the laws of Luxembourg, with registered office at 26, Boulevard Royal, L-2449 LUXEMBOURG, registered with the Register of Commerce and Companies of Luxembourg (Registre de Commerce et des Sociétés, Luxembourg) (“RCSL”), Section B under no. 239150, represented by Giorgio BIANCHI and Marco GOSTOLI, acting in their capacity as directors (administrateurs) with the right to joint signature; |

Hereinafter referred to as the “Borrower”;

| (3) | VDA Group S.p.A., a company incorporated and existing under the laws of Italy with registered office in Pordenone, Via Lino Zanussi 3, CAP 33170, corporate capital of Euro 172,233.50, registered under the Companies Registry of Pordenone under No. 00976420307, represented by Piercarlo GRAMAGLIA, acting in his capacity as CEO and empowered by resolution of the Board of Directors held on December 30, 2021; |

hereinafter being referred to as the “Guarantor” or “VDA Group”;

each a “Party” and, collectively, the “Parties.”

Recitals

| A. | WHEREAS the Borrower’s subscribed and fully paid in share capital is set at EUR 256,932 (two hundred and fifty-six thousand nine hundred and thirty-two euros), represented by 256,932 (two hundred and fifty-six thousand nine hundred and thirty-two) shares with a nominal value of EUR 1 (one euro) each, which are held as follows: |

1. METI HOLDING S.à r.l., a private limited company (société à responsabilité limitée), incorporated and existing under the laws of Luxembourg, with registered office at 26, Boulevard Royal, L-2449 LUXEMBOURG, registered with the RCSL, Section B under no. B217383 (“METI”) holder of 212,637 (two hundred twelve thousand six hundred thirty-seven) shares with a nominal value of EUR 1 (one euro) each, representing approximately 82.76% of the outstanding shares of the Borrower;

2. Mr. Arturo Iossa FASANO, with address at 15, Piazzale Segesta, I-20148 Milan (“Mr. FASANO”) holder of 44,295 (forty-four thousand two hundred ninety-five) shares with a nominal value of EUR 1 (one euro) each, representing approximately 17.24% of the outstanding shares of the Borrower.

- 1 -

| B. | WHEREAS the authorized capital of the Borrower (apart from the subscribed share capital) is set at EUR 159.480 (one hundred fifty nine thousand four hundred and eighty euros) allowing for the issuance of 159.480 (one hundred fifty nine thousand four hundred and eighty) new shares with a nominal value of EUR 1 (one euro) each, enjoying the same rights and benefits as the existing shares. |

| C. | WHEREAS at the date hereof, the Borrrower has full and unencumbered title to (detiene, in piena e libera proprietà) no. 6,499 (six thousand four hundred ninety-nine) ordinary shares of VDA Group S.p.A., which are issued in book-entry form (forma dematerializzata) and registered in the name of the Borrower in the securities account no. LU55 2981 0000 0005 6707opened by the Borrower with BPER Bank Luxembourg S.A., a joint stock company (société anonyme) incorporated and existing under the laws of Luxembourg, with registered office at 30, Boulevard Royal, L-2449 LUXEMBOURG, registered with the RCSL, Section B under no. 54033 (the “Depositary”) (the “Securities Account”), representing in aggregate a stake equal to 100% of the share capital of VDA Group; |

| D. | WHEREAS VDA Group is currently a party to certain Stock Purchase Agreement (the Stock Purchase Agreement together with all its annexes, enclosures, related and ancillary agreements and documents, “SPA”) entered into as of August 6, 2021, by and between VDA Group and Telkonet, Inc. (“TKOI”), a Utah corporation with registered address at 20800 SWENSON DRIVE STE 175 WAUKESHA, WI 53186. The SPA is fully documented and publicly disclosed pursuant to a “DEFINITIVE NOTICE AND PROXY STATEMENT“ (SEC Form DEF 14A) filed with the SEC on September 22, 2021, and further identified on EDGAR as SEC Accession No. 0001683168-21-004409 under File No.: 001-31972. The SPA requires, inter alia, (i) VDA Group to pay $5,000,000.00 (five million U.S. dollars) (the “SPA Payment”) to TKOI in exchange for title to 162,900,947 shares of Telkonet Common Stock (“TKOI Shares”) as well as a warrant and other rights enumerated in the SPA, (ii) that for a period of twelve months after the purchase of the TKOI Shares, VDA Group will not transfer any Telkonet shares owned by VDA Group or publicly disclose the intention to make any such transfer (“Lock-up Period”), and (iii) that neither the SPA nor any of a party’s rights thereunder may be assigned by any such party without the prior written consent of the other party, and any attempted assignment of the SPA or of any such rights by the Borrower without the consent of TKOI shall be void and of no effect (the “VDA-TKOI Stock Purchase”). |

| E. | WHEREAS the Parties are currently negotiating for the Lender to provide the Borrower with a convertible loan facility in the aggregate amount of $6,500,000.00 (six million five hundred thousand U.S. dollars) (the ““Investor Senior Loan”“ or the “Transaction”) for the funding of the VDA-TKOI Stock Purchase and the remaining $1,500,000.00 (one million five hundred thousand U.S. dollars) (“Residual Proceeds”) to be used by the Borrower solely for the purposes of financing working capital, providing acquisition financing, transaction expenses and for general corporate purposes. |

| F. | WHERAS on 6 January 2022, the Parties have entered into a US Law governed term sheet (the “Term Sheet”, Appendix 7). It is known to and accepted by the Borrower and the Guarantor that the entering into of the Term Sheet and the prospective to close the Transaction in Phase 2 is the primary inducement for the Lender to enter into this Agreement. |

| G. | WHEREAS given the contractual and timing constraints for VDA Group to make the SPA Payment, the Parties have determined to have the Lender provide a convertible loan facility (the “Loan”) to the Borrower in the amount of $5,000,000.00 (five million U.S. dollars) (the “Loan Amount”) to allow the Borrower to on-lend the proceeds of the Loan to VDA Group on an arm’s length basis, in order to allow VDA Group to close the SPA, to make the SPA Payment and to purchase the TKOI Shares (“Phase 1”). |

- 2 -

| H. | Whereas it is the intention of the Parties to then finalize the closing of the Transaction with accompanying Long-Form Agreement(s) (as defined below) for the Investor Senior Loan (“Phase 2”), it being understood that this Loan Agreement shall not be construed as a commitment to agree on and enter into a Long- Form Agreement for Phase 2. |

NOW THEREFORE IT IS HEREBY AGREED as follows:

| 1. | Definitions and Interpretation |

| 1.1 | Definitions |

In this Agreement (including the Recitals), the following terms not otherwise defined herein shall have the meanings indicated:

“Agreement” means this Convertible Loan Agreement as originally executed or as it may be amended from time to time.

“Appendix” means an appendix to this Agreement.

“Applicable Interest Rate” means a rate of zero basis points during the first six months as from the Drawdown. As from the Repayment Date, and unless a Long-Form Agreement has replaced this Loan Agreement, an interest at the rate for commercial transactions as determined in the law of April 18, 2004 regarding actions against late payments for commercial transactions, as amended, will apply on any outstanding amounts (including principal, Premium, fees and costs).

“Business Day” means a day (other than a Saturday or Sunday or public holiday) on which banks and foreign exchange markets are open for general business in Luxembourg.

“Conditions Precedent” has the meaning assigned to such term in Clause 5.

"Disruption Event" means either or both of:

(a) a material disruption to those payment or communications systems or to those financial markets which are, in each case, required to operate in order for payments to be made which disruption is not caused by, and is beyond the control of, any of the Party whose operations are disrupted; or

(b) the occurrence of any other event which results in a disruption (of a technical or systems-related nature) to the treasury or payments operations of a Party preventing payments to be made which disruption is not caused by, and is beyond the control of the Party whose operations are disrupted.

“Drawdown” means the act of the Borrower of borrowing under the Agreement.

“Drawdown Date” means the date on which the Drawdown of the Loan is made.

“Drawdown Request” means a drawdown request, substantially in the form set out in Appendix 1.

“Effective Date” means the date of the Drawdown.

“Event of Default” has the meaning assigned to such term in Clause 10 hereof.

“Finance Document” means this Agreement, the Security Documents, the Subordination Agreement” and any ancillary document or additional accession, guarantee or security document.

"Financial Indebtedness" means any indebtedness for or in respect of:

| (a) | moneys borrowed; |

- 3 -

| (b) | any amount raised pursuant to any note purchase facility or the issue of bonds, notes, debentures, loan stock or any similar instrument; |

| (c) | the amount of any liability in respect of any lease or hire purchase contract which would, in accordance with GAAP, be treated as a balance sheet liability; |

| (d) | receivables sold or discounted; |

| (e) | any amount raised under any other transaction (including any forward sale or purchase agreement) of a type not referred to in any other paragraph of this definition having the commercial effect of a borrowing; |

| (f) | any derivative transaction entered into in connection with protection against or benefit from fluctuation in any rate or price (and, when calculating the value of any derivative transaction, only the marked to market value (or, if any actual amount is due as a result of the termination or close-out of that derivative transaction, that amount) shall be taken into account); |

| (g) | any counter-indemnity obligation in respect of a guarantee, indemnity, bond, standby or documentary letter of credit or any other instrument issued by a bank or financial institution; and |

| (h) | the amount of any liability in respect of any guarantee or indemnity for any of the items referred to in paragraphs (a) to (g) above. |

“Investor Senior Loan” has the meaning conferred to it in the Recitals point E.

“Loan” has the meaning conferred to it in the Recitals point F.

“Loan Amount” has the meaning conferred to it in the Recitals point F.

“Loan Term” means a period of six (6) months commencing on the Effective Date.

“Long-Form Agreement(s)” means an agreement containing the terms of the Phase 1 and the Investor Senior Loan herein, as applicable.

"Material Adverse Effect" means a material adverse effect on (a) the business, assets, properties, liabilities (actual or contingent), operations, financial condition or business prospects, of the Borrower, individually, or the Borrower and its Subsidiaries taken as a whole; or (b) the ability of an Obligor to perform its obligations under any Finance Document; or (c) the validity or enforceability of, or the effectiveness or ranking of any security granted or purported to be granted pursuant to any of, the Finance Documents; or (d) the rights or remedies of the Lender under any of the Finance Documents.

“Material Agreement” means any contract or other arrangement (other than the Finance Documents), whether written or oral, to which the Borrower, individually, or the Borrower and its Subsidiaries taken as a whole is a party as to which the breach, non-performance, cancellation or failure to renew by any party thereto could reasonably be expected to have a Material Adverse Effect.

“Obligor” means the Borrower and VDA Group as Guarantor, and any other party that may in the future become an obligor.

“Phase 1” has the meaning conferred to it in the Recitals point F.

“Phase 2” has the meaning conferred to it in the Recitals point G.

“Premium” means the 500,000 United States Dollars premium to the Lender for making the Loan available to the Borrower referred to in Clause 7.1.

“Security Documents” means the VDA Holding Share Pledge Agreement, the VDA Group Share Pledge Agreement and the Subordination Agreement.

- 4 -

“SPA” has the meaning conferred to it in the Recitals point D.

“SPA Payment” has the meaning conferred to it in the Recitals point D.

“Subordination Agreement” has the meaning conferred to it in Clause 4.

“Recitals” are the recitals to this Agreement.

“Repayment Date” means the date falling six calendar months from the Effective Date.

“Taxes” means any taxes (including interest or penalties thereon) which are now or at any time hereafter imposed, assessed, charged, levied, collected, demanded, withheld or claimed by the United States or Luxembourg or any tax authority thereof or therein or any other jurisdiction through which the Borrower is directed by the Lender to effect payments.

“TKOI” has the meaning conferred to it in the Recitals point D.

“TKOI Bank Account” has the meaning conferred to it in the Clause 2.2.

“TKOI Shares” has the meaning conferred to it in the Recitals point D.

“Transaction” has the meaning conferred to it in the Recitals point E.

“VDA Group” has the meaning conferred to it in the Recitals point C.

“VDA Group Share Pledge Agreement” has the meaning conferred to it in the Clause 3.3.2.

“VDA Holding Share Pledge Agreement” has the meaning conferred to it in Clause 3.3.1.

“VDA-TKOI Stock Purchase” has the meaning conferred to it in the Recitals point D.

| 1.2 | Interpretation |

Unless the context or the express provisions of this Agreement otherwise require, the following shall govern the interpretation of this Agreement:

| 1.2.1 | All references to “Clause” or “sub-Clause” are references to a Clause or sub-Clause of this Agreement. |

| 1.2.2 | The terms “hereof”, “herein” and “hereunder” and other words of similar import shall mean this Agreement as a whole and not any particular part hereof. |

| 1.2.3 | Words importing the singular number include the plural and vice versa. |

| 1.2.4 | The headings are for convenience only and shall not affect the construction hereof. |

| 2. | LOAN |

| 2.1 | Loan |

On the terms and subject to the conditions set forth herein, and subject to the fulfilment of the Conditions Precedent, the Lender will make available to the Borrower a loan in the amount of USD 5,000,000 (five million U.S. dollars).

The Loan will be used solely to allow VDA Group to purchase TKOI Shares.

| 2.2 | Drawdown |

Subject to the conditions of this Agreement, the Borrower may request the paying out of the Loan by delivering a completed Drawdown Request to the lender by not later than 10.00 a.m. one Business Day before the proposed Drawdown Date (or such shorter time as agreed by the Parties). The deadline to exercise the Drawdown is 20 January 2022. The Drawdown can only be made one time and for the full Loan Amount

- 5 -

The payment of the Loan will be effected by wire transfer directly to the Bank Account of TKOI Beneficiary Acct#: 501059612, ABA#: 12114, with Heritage Bank of Commerce, 224 Airport Pkwy, San Jose, CA 95110, USA (the “TKOI Bank Account”).

The Lender will instruct its bank or paying agent (as the case may be) in such way that it will bear the costs of the wire transfer, so that the net amount of USD 5,000,000 (five million U.S. dollars) will be transferred to the TKOI Bank Account. The Borrower commits to reimburse the Lender within five (5) business days for any such banking / wire transfer cost.

| 3. | COLLATERALS |

To secure the repayment of the Loan, the collaterals listed below will be granted to the Lender:

3.1 The shareholders of the Borrower will grant on the date hereof a pledge over the shares held by them in the Borrower. A draft of the share pledge agreement between the shareholders of the Borrower, the Lender and the Borrower is attached hereto under Appendix 2 (the “VDA Holding Share Pledge Agreement”).

3.2 The Borrower will grant on the date hereof a pledge over the shares held by it in VDA Group. A draft of the share pledge agreement between the Borrower, the Lender and VDA Group is attached hereto under Appendix 3 (the “VDA Group Share Pledge Agreement”).

| 4. | SUBORDINATION |

The Lender has agreed to make available to the Borrower the Loan Amount on the condition that all the debts due by the Borrower to the creditors listed below are subordinated to the Loan (including the principal amount, any premium, interest, costs and fees), including but not limited to the debts listed below :

4.1 Debt to METI HOLDING SARL amounting to EUR 511,500.00 as at October 18, 2021.

4.2 Debt to MULTIMEDIA SRL (formerly VDA MULTIMEDIA SpA) amounting to EUR 1,260,562.19, as at October 18, 2021.

4.3 Debt to DISTRESS TO VALUE SA amounting to EUR 2,100,000.00 as principal and EUR 278,238.85 as interest, as at October 18, 2021.

The above figures are from the interim accounts of the Borrower dated 18 October 2021.

A draft of the subordination agreement relating to all the debts towards the creditors listed under 4.1, 4.2 and 4.3 are attached hereto under Appendix 4 (the “Subordination Agreement”).

| 5. | CONDITIONS PRECEDENT FOR DRAWDOWN |

The Drawdown of the Loan is subject to the following conditions precedent (the “Conditions Precedent”):

| 5.1 | Due execution of the Subordination Agreement; |

| 5.2 | Due execution and perfection of the VDA Holding Share Pledge Agreement; |

| 5.3 | Due execution and perfection of the VDA Group Share Pledge Agreement; |

| 5.4 | Delivery to the Depositary of the notice pursuant to the form set forth in the Schedule 2 of the VDA Group Share Pledge Agreement. |

- 6 -

| 6. | Repayment and Prepayment |

| 6.1 | Repayment |

Except as otherwise provided herein, the Borrower shall repay the Loan in full, including the principal amount, and the Premium, at the expiration of the Loan Term (“Repayment Date”).

| 6.2 | Prepayment |

The Borrower may prepay the Loan in whole or in part at any time in accordance with the express terms of this Agreement. Prepayments may occur upon five (5) Business Days’ notice. A prepayment shall have no impact on the Premium or any costs or fees, which – subject to the provisions of this Agreement - will remain due in full regardless of such prepayment or the date thereof.

| 7. | PREMIUM and Interest |

| 7.1 | Premium |

On the Repayment Date, the Borrower shall pay to the Lender, in addition to the principal amount, a US $500,000.00 (five hundred thousand U.S. dollars) premium (the “Premium”) (but no other interest).

The Premium is not applicable, and no amounts will be due by the Borrower in relation thereof, if the Investor Senior Loan is agreed on by the Parties in one or several Long-Form Agreement(s) prior to the Repayment Date, which Long-Form Agreement(s) will include the interest then applicable, or if the Lender converts the Loan Amount under Section 9.1.

| 7.2 | Interest |

If the Investor Senior Loan is agreed on by the Parties in one or several Long-Form Agreement(s) prior to the Repayment Date, and therefore the Premium is not applicable, the interest to be applied on the Loan as from the Effective Date will be agreed in the Investor Senior Loan agreement.

| 8. | Payments – Gross-Up, Set-Off or Counterclaim |

The Borrower shall indemnify the Lender against any increase in lending costs which might occur due to withholding tax.

All payments to be made by the Borrower to the Lender under this Agreement shall be made in full without set-off or counterclaim and (except to the extent required by law) free and clear of, and without deduction for, or on account of, any Taxes. If the Borrower shall be required by applicable law to make any deduction or withholding from any payment under this Agreement, it shall increase any payment due hereunder to such amount as may be necessary to ensure that the Lender receives a net amount equal to the full amount which it would have received had payment not been made subject to such Taxes or any other deduction. In the event that any of these taxes or other levies will be refundable, the Lender and Borrower will cooperate to get them refunded.

| 9. | CONVERSION OPTION |

9.1 On the date falling six calendar months from the Effective Date and on the conditions that (i) the Investor Senior Loan is not entered into by the Borrower and the Lender and (ii) the Borrower does not repay the Loan Amount and the Premium, the Lender may, at its sole discretion and upon 30 days’ written notice to the Borrower, elect to convert the outstanding Loan Amount by requiring the Borrower to terminate the Loan in exchange for issuance of additional shares of the Borrower allowing the Lender to be holder of 38,30% of the share capital of the Borrower.

9.2 Any shares arising as a result of a conversion pursuant to this clause shall, as from conversion, rank pari passu in all respects with the other ordinary shares of the Borrower for the time being in issue save that any entitlement to dividend attributable to such new ordinary shares in respect of the financial year of the Borrower in which the conversion date falls shall accrue on a daily basis as from (but excluding) the conversion date. Upon conversion, each of the VDA Group Share Pledge Agreement and the VDA Holding Share Pledge Agreement shall terminate and any shares pledged thereunder released from pledge, and the Subordination Agreement shall terminate.

- 7 -

| 10. | Borrower Covenants |

| 10.1 | Negative pledge |

(a) The Borrower shall not create or permit to subsist any security interest over any of its assets and shall procure that the Guarantor does not create any new security interest.

(b) The Borrower shall not:

(i) sell, transfer or otherwise dispose of any of its assets on terms whereby they are or may be leased to or re-acquired by the Borrower;

(ii) sell, transfer or otherwise dispose of any of its receivables on recourse terms;

(iii) enter into any arrangement under which money or the benefit of a bank or other account may be applied, set-off or made subject to a combination of accounts; or

(iv) enter into any other preferential arrangement having a similar effect,

in circumstances where the arrangement or transaction is entered into primarily as a method of raising financing for its operations or of financing the acquisition of an asset.

(c) Paragraphs (a) and (b) above do not apply to any security, listed below:

(i) the Security Documents;

(ii) any statutory lien existing as of the date hereof;

(iii) any lien arising in the ordinary course of business;

(iv) any security that is released prior to the Drawdown;

(v) any lien arising by operation of law.

| 10.2. | Disposals |

(a) The Borrower shall not enter into a single transaction or a series of transactions (whether related or not and whether voluntary or involuntary) to dispose of all or any part of any material asset.

(b) It is understood between the Parties that in case the Investor Senior Loan is not entered into by the Borrower and the Lender by February 26, 2022, or the different day mutually agreed in writing by the Parties, the Borrower will need to repay the Loan Amount and the Premium, therefore the Borrower and VDA Group will not be restricted in carrying out any transaction (including but not limited to, disposal, sale, transfer, pledge, encumber or otherwise disposal of any shares of capital stock or any other instruments representing the capital or giving access to the shares of VDA Group or the Borrower) under the conditions that such transaction (i) effectively ensures the repayment of the Loan Amount and the Premium; and (ii) will not decrease or deprive until the repayment of the Loan and the Premium, the security interest granted to the Lender by the Security Documents; and (iii) until the Loan Amount and the Premium is repaid, will not create any Financial Indebtedness unsubordinated to the Loan, the Premium and any other claims of the Borrower under this Agreement; and (iv) until and as from the Loan Amount and the Premium being repaid, not have a Material Adverse Effect on the going concern prospective of the Borrower.

- 8 -

(c) Without prejudice to the provisions under paragraph (b) above, paragraph (a) above does not apply to any disposal made in the ordinary course of business, and on arm's length terms to an unrelated third party.

(d) Without prejudice to the provisions under paragraph (b) above, the Borrower specifically undertakes not to sell, transfer, pledge, encumber or otherwise dispose of any shares of capital stock or any other instruments representing the capital or giving access to the shares of VDA Group, save for the VDA Group Share Pledge Agreement.

(d) VDA Group specifically undertakes not to sell, transfer, pledge, encumber or otherwise dispose of any shares of capital stock or any warrants issued by TKOI.

| 10.3 | Financial Indebtedness |

| (a) | The Borrower may not incur or permit to be outstanding any Financial Indebtedness. |

| (b) | Paragraph (a) above does not apply to: |

(i) any Financial Indebtedness incurred under the Loan;

(ii) any debt subordinated under the Subordination Agreement;

(iii) any Financial Indebtedness repaid prior to the Drawdown;

(iv) any Financial Indebtedness existing as of the date hereof listed in Appendix 6;

(v) any Financial Indebtedness incurred in the normal course of business.

(vi) any Financial Indebtedness of VDA Group to the Borrower in relation to the Loan Amount lent by Borrower to VDA Group.

| 10.4 | Lending and guarantees |

The Borrower shall not give or allow to be outstanding any guarantee or indemnity to or for the benefit of any person in respect of any obligation of any other person relating to Financial Indebtedness or enter into any document under which the Borrower assumes any liability of any other person other than any guarantee or indemnity given under the Loan or the Security Documents.

| 10.5 | Merger |

(a) The Borrower shall not enter into any amalgamation, merger, demerger, or corporate reconstruction other than on terms approved by the Lender (acting reasonably).

| 10.6 | Change of business |

| (a) | The Borrower may not carry on any material business other than its current activities exercised in the normal course of business. |

| (b) | The Borrower may not acquire, incorporate or create any new subsidiary or branch without approval by the Lender (acting reasonably). |

| 10.7 | Acquisitions |

The Borrower may not make any acquisition or investment other than as permitted under this Agreement or the acquisition of any other assets in connection with the ordinary course of its business.

| 10.8 | Other agreements |

The Borrower may not enter into any Material Agreement other than:

(a) the Loan and the documents contemplated therein;

- 9 -

(b) any other agreement expressly allowed under any other term of this Agreement; or

(c) any other agreement entered into by the Borrower in the ordinary course of its business.

| 10.9 | Shares, dividends and share redemption |

(a) The Borrower shall not issue any further shares unless provided for in this Agreement or amend any rights attaching to its issued shares in a manner which could be reasonably expected to be materially prejudicial to the Lender.

(b) The Borrower shall not:

(i) declare, make or pay any dividend, charge, fee or other distribution (or interest on any unpaid dividend, charge, fee or other distribution) (whether in cash or in kind) on or in respect of its share capital (or any class of its share capital);

(ii) repay or distribute any dividend or share premium reserve;

(iii) pay any management, advisory or other fee to the shareholders of the Borrower; or

(iv) redeem, repurchase, defease, retire or repay any of its share capital or resolve to do so.

10.10 Taxes

(a) The Borrower must pay all taxes due and payable by it prior to the accrual of any fine or penalty for late payment, unless (and only to the extent that):

(i) payment of those taxes is being contested in good faith and adequate reserves are being maintained for those taxes and the costs required to contest them; or

(ii) such payment can be lawfully withheld and failure to pay those taxes is not reasonably likely to have a Material Adverse Effect and provided that the Borrower shall take all reasonable steps to ensure that such taxes are paid and discharged as soon as reasonably practicable.

(b) The Borrower must ensure that its residence for tax purposes is in its jurisdiction and that it does not have a branch, agency or permanent establishment or permanent representative in any other jurisdiction.

(c) The Borrower must comply with all tax filing and reporting obligations.

10.11 Information and Reporting

From the date of this Agreement and for so long as any amount is outstanding under this Agreement:

(a) the Borrower shall provide the Lender, out of its own initiative and promptly upon becoming aware of it, with information on all material events related to the Borrower, its assets or its business, that are likely to affect its capacity to honor its obligations towards the Lender, or that are likely to have another Material Adverse Effect for the Lender, and in particular the details of any litigation, arbitration or administrative proceedings or investigations which are current, threatened or pending against the Borrower or any member of the Borrower’s group;

(b) the Borrower shall provide the Lender with a copy of its statutory and customary filings and reports, including in particular its financial statements, intermediary balance sheets, quarterly reports etc., and at the same time as they are dispatched, copies of all documents dispatched by the Borrower to its shareholders generally or its creditors generally (or any class of them);

(c) the Borrower shall promptly provide the Lender with all information and documents reasonably requested by the Lender regarding the financial condition, business and operations of the Borrower or any member of the Borrower’s group;

- 10 -

(d) the Borrower shall allow the Borrower to have any information provided by or on behalf of it to the Lender verified, as the case may be on location, by an independent auditor sworn to professional secrecy and shall provide such auditor with full access to its premises, books, records and data.

(e) The Borrower shall provide within 15 January 2022 the Lender with a copy (certified by a director) of (i) the agreement executed between the Borrower and the Guarantor in respect of the Loan amount lent by the Borrower to VDA Group and (ii) the resolution of the board of directors of the Guarantor held on December 30, 2021.

10.12 Term Sheet

The Borrower shall respect the Binding Terms (as defined in the Term Sheet) of the Term Sheet, and any breach by the Borrower of the Binding Terms of the Term Sheet shall also be a breach of this Agreement.

10.13 VDA Group

VDA Group undertakes to respect, and the Borrower shall procure that VDA Group shall equally respect, mutatis mutandis, the provisions in this Clause 10.

11. TERMINATION BY LENDER AND Events of Default

The Lender may terminate this Agreement upon one month’s written notice to the Borrower in an Event of Default. Each of the following constitutes an “Event of Default” with respect to the Loan. The Lender may accelerate the Loan during a continuation of any of the following events:

| 11.1 | Failure to pay principal, and/ or Premium and/or interests when due. |

| 11.3 | Failure by the Borrower or VDA Group to satisfy when due any material liens, claims, or judgments against the Borrower or VDA Group, in any event each individually for an amount not lower than EUR 10,000.00 and in the aggregate EUR 50,000.00, unless its failure to pay is caused by (i) an administrative or technical error; or (ii) a Disruption Event; and payment is made within three (3) Business Days of its due date. |

| 11.4 | Any material misrepresentation or material breach of any covenant in any documents or submissions made by the Borrower in this Agreement, in any Security Document or in the Subordination Agreement. |

| 11.5 | Failure to cure defaults not detailed above within the applicable cure periods. |

| 11.6 | The Borrower defaults in the performance or observance of any of its obligations under or in respect of this Agreement (other than a payment obligation in respect to the principal, and/ or Premium and/or interests) and/or the Security Documents and/ or any other Finance Document and such default (if capable of being remedied) is not remedied within thirty (30) days. |

| 11.7 | Filing or action for VDA Group to be declared in a state of insolvency or any similar proceedings affecting the rights of creditors generally, including any proceedings provided for by Italian Royal Decree of 16 March 1942, No. 267, as amended, supplemented or replaced from time to time also by Italian Legislative Decree of 12 January 2019, No. 14. |

| 11.8 | Filing or action against the Borrower to obtain the bankruptcy (faillite), insolvency, moratorium (moratoire), controlled management (gestion contrôlée), suspension of payments (sursis de paiement), court-ordered liquidation (liquidation judiciaire), voluntary liquidation (liquidation volontaire) or reorganization or any similar proceedings affecting the rights of creditors generally. |

- 11 -

| 11.9 | If the Borrower or VDA Group (i) is unable or admits inability to pay its debts as they fall due; or (ii) is deemed to, or is declared to, be unable to pay its debts under applicable law; or (iii) suspends or threatens to suspend making payments on any of its debts; or (iv) by reason of actual or anticipated financial difficulties, commences negotiations with one or more of its creditors (excluding the Lender in its capacity as such) with a view to rescheduling any of its indebtedness. |

| 11.10 | Any attachment, sequestration, distress or execution or any analogous process in any jurisdiction that affects any asset or assets of the Borrower or VDA Group and is not discharged within twenty (20) Business Days. |

| 11.11 | The Borrower or VDA Group ceases to carry on (or threatens to cease to carry on) all or a substantial part of its business except as a result of any disposal allowed under this Agreement. |

| 11.12 | It is or becomes unlawful for the Borrower or VDA Group to perform any of its obligations under this Agreement or a Security Document created or expressed to be created or any subordination created under the Subordination Agreement is or becomes unlawful. |

| 11.13 | Any obligation or obligations of the Lender or VDA Group under this Agreement or a Security Document are not or cease to be legal, valid, binding or enforceable and the cessation individually or cumulatively materially and adversely affects the interests of the Lender. |

| 11.14 | The Loan or a Security Document ceases to be in full force and effect or any subordination created under the Subordination Agreement ceases to be legal, valid, binding, enforceable or effective or is alleged by a party to it (other than the Lender) to be ineffective. |

| 11.15 | The Borrower or VDA Group rescinds or purports to rescind or repudiates or purports to repudiate all or part of this Agreement, a Security Agreement or the Subordination Agreement. |

| 10.16 | Any other material change that may adversely affect the Borrower's ability to fulfill its obligations under this Agreement. |

| 11. | Acceleration |

At any time after the occurrence of an Event of Default which is continuing, the Lender may, by written notice to the Borrower:

| 11.1 | declare all or part of the Loan, accrued by the Premium as well as all accrued interest thereon and any other sum then payable under this Agreement to be immediately due and payable, whereupon such amounts shall become so due and payable; and/or |

| 11.2 | declare all or part of the Loan to be payable on demand whereupon the same shall become payable on demand. |

| 12. | REPRESENTATIONS AND WARRANTIES |

| 12.1 | Each of the Parties hereby represents, warrants and undertakes to the other that: |

| a) | it has the legal right, full power and authority to execute and deliver, and to exercise its rights and perform its obligations under this Agreement; |

| b) | all corporate action required by it to validly and duly authorise the execution and delivery of, and the exercise of its rights and the performance of its obligations under this Agreement has been duly taken; |

- 12 -

| c) | the execution and performance of this Agreement does not and will not breach its articles of incorporation or other constitutional documents or any agreement or obligation by which it is bound or violate any applicable law; |

| d) | this Agreement (when executed) will constitute its valid and binding obligations, enforceable in accordance with its terms; |

| 12.2 | The Borrower further gives the Warranties and makes the Representations in Appendix 5 to this Agreement. |

12.3 Lender represents and warrants to, and agrees with, the Borrower that the following is true and complete as of the Closing:

| a) | Purchase for Own Account. The Lender understands that the Note has not been registered, and will not be registered, under the Securities Act of 1933, as amended (the “Act”) on the basis of the exemption provided by Section 4(a)(2) of the Act and Regulation D promulgated thereunder. The Lender represents that it is acquiring the Loan and as the case may be, the Conversion Shares solely for its own account and beneficial interest for investment and not for sale or with a view to distribution of the Loan or Conversion Shares or any part thereof. |

| b) | Information and Sophistication. The Lender hereby: (a) acknowledges that it has received certain information it has requested from the Borrower, but that due to the time constraints on the Borrower’s side it has not been able to perform a comprehensive due diligence on the Borrower, its assets and its business, so that the Lender has decided whether to make the Loan and as the case may be acquire the Conversion Shares based on the information received from the Borrower, and the representations, warranties and covenants of the Borrower; and (b) further represents that it has such knowledge and experience in financial and business matters that it is capable of evaluating the merits and risk of this investment. |

| c) | Ability to Bear Economic Risk. The Lender acknowledges that investment in the Loan or Conversion Shares involves a degree of risk, and represents that it is able, without materially impairing its financial condition, and without being obliged to do so, to hold the Loan or Conversion Shares for an indefinite period of time. |

| d) | Restricted Securities. The Lender is aware that the Loan and Conversion Shares or any portion thereof are deemed “restricted securities” (as defined under Rule 144(a)(3) under the Act) and may not be sold unless an applicable exemption exists under applicable US and/or non-US securities laws. |

| e) | Accredited Investor Status. The Lender is an “Accredited Investor” as such term is defined in Rule 501(a) under the Act. |

| f) | Further Limitations on Disposition. Without in any way limiting the representations set forth above, the Lender further agrees not to make any disposition of all or any portion of the Loan or Conversion Shares unless and until: |

| (i) | There is then in effect a Registration Statement under the Act covering such proposed disposition and such disposition is made in accordance with such Registration Statement; or |

| (ii) | The Lender shall have notified the Borrower of the proposed disposition and if reasonably requested by the Borrower, Lender shall have furnished the Borrower with an opinion of counsel, reasonably satisfactory to the Borrower, that such disposition will not require registration under the Act or any applicable state securities laws. |

- 13 -

| g) | No Bad Actor Disqualification. No “bad actor” disqualifying event described in Rule 506(d)(1)(i)-(viii) of the Act (a “Disqualification Event”) is applicable to the Lender or, to the Lender’s knowledge, any Lender Covered Person (as defined below), except for a Disqualification Event as to which Rule 506(d)(2)(ii-iv) or (d)(3), is applicable. |

“Lender Covered Person” means, with respect to the Lender as an “issuer” for purposes of Rule 506 promulgated under the Act, any Person listed in the first paragraph of Rule 506(d)(1).

| 13. | GUARANTEE: |

| 13.1. | VDA Group as Guarantor irrevocably and unconditionally, jointly and severally (solidairement et indivisiblement) as a principal obligor and not merely as a surety and on the basis of obligations directly enforceable against it: |

| a) | guarantees to the Lender punctual performance by each other Obligor of all that Obligor’s obligations under this Agreement or any other Finance Document; |

| b) | undertakes with the Lender that whenever an Obligor does not pay any amount when due under or in connection with any Finance Document, it shall immediately on demand pay that amount as if it was the principal obligor; and |

| c) | agrees with the Lender that if any obligation guaranteed by it is or becomes unenforceable, invalid or illegal, it will, as an independent and primary obligation, indemnify the Lender immediately on demand against any cost, loss or liability it incurs as a result of an Obligor not paying any amount which would, but for such unenforceability, invalidity or illegality, have been payable by it under a Finance Document on the date when it would have been due. |

| 13.2 | Continuing Guarantee |

This guarantee is a continuing guarantee and will extend to the ultimate balance of sums payable by any Obligor under Finance Document regardless of any intermediate payment or discharge in whole or in part.

| 13.3 | Reinstatement |

If any payment by any Obligor or any discharge, release or arrangement given by the Lender (whether in respect of the obligations of any Obligor or any security for those obligations or otherwise) is avoided or reduced for any reason whatsoever (including, without limitation, as a result of insolvency, business rescue proceedings, administration, liquidation, winding-up or otherwise):

| d) | the liability of each Obligor shall continue as if the payment, discharge, avoidance or reduction had not occurred; and |

| e) | the Lender shall be entitled to recover the value or amount of that security or payment from each Obligor, as if the payment, discharge, avoidance or reduction had not occurred. |

| 13.4 | Waiver of Defences |

The obligations of the Guarantor under this Clause 13 will not be affected by any act, omission, matter or thing which, but for this Clause, would reduce, release or prejudice any of its obligations under this Clause 13 (without limitation and whether or not known to it or to the Lender) including:

| a) | any time, waiver or consent granted to, or composition with, any Obligor or other person; |

- 14 -

| b) | the release of any other Obligor or any other person under the terms of any composition or arrangement with any creditor; |

| c) | the taking, variation, compromise, exchange, renewal or release of, or refusal or neglect to perfect, take up or enforce, any rights against, or security over assets of, any Obligor or other person or any non-presentation or non-observance of any formality or other requirement in respect of any instrument or any failure to realise the full value of any security; |

| d) | any incapacity or lack of power, authority or legal personality of or dissolution or change in the members or status of an Obligor or any other person; |

| e) | any amendment, novation, supplement, extension, restatement (however fundamental and whether or not more onerous) or replacement of any Finance Document or any other document or security including without limitation any change in the purpose of, any extension of or any increase in any facility or the addition of any new facility under any Finance Document or other document or security; |

| f) | any unenforceability, illegality, invalidity suspension or cancellation of any obligation of any person under any Finance Document or any other document or security; |

| g) | any insolvency, liquidation, winding-up, business rescue or similar proceedings (including, but not limited to, receipt of any distribution made under or in connection with those proceedings); |

| h) | this Agreement or any other Finance Document not being executed by or binding against any other Guarantor or any other party; or |

| i) | any other fact or circumstance arising on which a Guarantor might otherwise be able to rely on a defence based on prejudice, waiver or estoppel. |

| 13.5 | Guarantor intent |

Without prejudice to the generality of Clause 13.4 (Waiver of defences), the Guarantor - also in derogation to article 1956 of the Italian Civil Code - expressly confirms that it intends that this guarantee shall extend from time to time to any (however fundamental) variation, increase, extension or addition of or to any of the Finance Documents and/or any facility or amount made available under any of the Finance Documents for the purposes of or in connection with any of the following: business acquisitions of any nature; increasing working capital; enabling investor distributions to be made; carrying out restructurings; refinancing existing facilities; refinancing any other indebtedness; making facilities available to new borrowers; any other variation or extension of the purposes for which any such facility or amount might be made available from time to time; and any fees, costs and/or expenses associated with any of the foregoing.

| 13.6 | Immediate Recourse |

The Guarantor waives any right it may have of first requiring the Lender to proceed against or enforce any other rights or security or claim payment from any person before claiming from that Guarantor under this Clause 13. This waiver applies irrespective of any law or any provision of a Finance Document to the contrary.

- 15 -

| 13.7 | Appropriations |

Until the full discharge of the obligations of the Borrower and any other Obligor or Guarantor, the Lender may:

| a) | refrain from applying or enforcing any other moneys, security or rights held or received by it in respect of those amounts, or apply and enforce the same in such manner and order as it sees fit (whether against those amounts or otherwise) and the Guarantor shall be not entitled to the benefit from the same; and |

| b) | hold in an interest-bearing suspense account any moneys received from any Guarantor or on account of any Guarantor’s liability under this Clause 13. |

| 13.8 | Deferral of Guarantors’ Rights |

Until the full discharge and unless the Lender otherwise directs, the Guarantor will not exercise any rights which it may have by reason of performance by it of its obligations under the Finance Documents or by reason of any amount being payable, or liability arising, under this Clause 13:

| a) | to be indemnified by an Obligor; |

| b) | to claim any contribution from any other guarantor of or provider of security for any Obligor’s obligations under the Finance Documents; |

| c) | to take the benefit (in whole or in part and whether by way of subrogation, cession of action or otherwise) of any rights of the Finance Parties under the Finance Documents or of any other guarantee or security taken pursuant to, or in connection with, the Finance Documents by any Finance Party; |

| d) | to bring legal or other proceedings for an order requiring any Obligor to make any payment, or perform any obligation, in respect of which any Guarantor has given a guarantee, undertaking or indemnity under Clause 13.1 (Guarantee and Indemnity); |

| e) | to exercise any right of set-off against any Obligor; and/or |

| f) | to claim, rank, prove or vote as a creditor or shareholder of any Obligor in competition with any Finance Party. |

| g) | If the Guarantor receives any benefit, payment or distribution in relation to such rights, it shall hold that benefit, payment or distribution to the extent necessary to enable all amounts which may be or become payable to the Lender by the Obligors under or in connection with the Finance Documents to be repaid in full on trust for, or otherwise for the benefit of, the Lender and shall promptly pay or transfer the same to the Lender. |

| 13.9 | Additional Security |

This guarantee is in addition to and is not in any way prejudiced by any other guarantee or security now or subsequently granted to the benefit or held by the Lender.

| 13.10 | Limitation |

a) In any event and independent of provisions to the contrary in this Agreement, the Parties agree, including pursuant to Article 1938 of the Italian Civil Code, that the maximum amount that VDA Group must pay under its obligations as Guarantor pursuant to this Agreement shall not exceed the total of:

(i) the aggregate amount of any loan made available to the Guarantor by the Borrower on the basis of the on-lending referred to in Recital F;

- 16 -

(ii) any shareholder loan in favor of the Guarantor; and

(iii) any other credit granted from time to time under a documentary letter of credit, a guarantee, or any other transaction establishing a financial obligation by the Borrower or another member of its group from which the Guarantor or one of its subsidiaries receives a direct advantage;

PROVIDED THAT the maximum liability of the Guarantor pursuant to this Agreement shall not exceed, in any case, USD 6,700,000 (six million seven hundred thousand United States Dollars).

b) Obligations of the Guarantor shall not include, and shall not extend to any indebtedness (if any) incurred by the Borrower in respect of any amounts of the Loan the purpose or actual use of which is:

(i) the acquisition of the Guarantor (and/or of any entity controlling it), including any related costs and expenses; or

(ii) a subscription for any shares in the Guarantor (and/or any entity controlling it), including any related costs and expenses; or

(iii) the refinancing thereof.

c) With respect to the fulfilment of mandatory requirements under Italian law, with reference to (A) the maximum allowable interest rate (namely Italian Law no. 108 of 7 March 1996, as amended, transposed, or supplemented from time to time, as well as Article 1815 of the Italian Civil Code) and (B) the capitalization of interest (namely Article 1283 of the Italian Civil Code and Article 120 of the Italian Legislative Decree No. 385 of 1 September 1993), the Parties agree that the obligations of the Guarantor under this section do not contain or include (1) any interest that, pursuant to Italian Law no. 108 of 7 March 1996, as amended, transposed, or supplemented from time to time, is to be classified as usurious and (2) any compound interest on amounts in arrears which violate the provisions of Article 1283 of the Italian Civil Code and Article 120 of the Italian Legislative Decree No. 385 of 1 September 1993 and any relevant implementing regulation, each as amended, supplemented or implemented from time to time.

| 14. | General |

| 14.1 | Waivers |

No failure to exercise and no delay in exercising, on the part of the Lender or the Borrower, any right, power or privilege hereunder and no course of dealing between the Borrower and the Lender shall operate as a waiver thereof, nor shall any single or partial exercise of any right, power or privilege preclude any other or further exercise thereof, or the exercise of any other right, power or privilege. The rights and remedies herein provided are cumulative and not exclusive of any rights or remedies provided by applicable law.

- 17 -

| 14.2 | Notices |

All notices, requests, demands or other communication to or upon the respective parties hereto shall be given or made in the English language in writing and shall be deemed to have been duly given or made at the time of delivery, if delivered by hand or courier, or if sent by facsimile, at the time of transmission (in each case, if given during normal business hours of the recipient, and on the Business Day during which such normal business hours next occur if not given during such hours on any day), to the party to which such notice, request, demand or other communication is required or permitted to be given or made under this Agreement addressed as follows:

If to the Lender:

Address: NOMADIX HOLDINGS LLC, 1209 Orange St., New Castle, Wilmington, DE 19801

Email: jack@gatewh.com

Attention: Jack Brannelly

if to the Borrower:

Address: VDA Holding S.A., 26, Boulevard Royal, L-2449 LUXEMBOURG

Email: gbianchi@essedi.lu

Attention: Giorgio BIANCHI

If to the Guarantor:

Address: VDA Group S.p.A., Pordenone, Via Lino Zanussi 3, CAP 33170, Italy

Email: piercarlo.gramaglia@vdagroup.com

Attention: Piercarlo GRAMAGLIA

- 18 -

or to such other address or Email as any party may hereafter specify in writing to the other. 12.3 Bank Accounts.

14.3.1 Any payment made by the Lender to TKOI will be done to the following bank account:

Bank: Heritage Bank of Commerce 224 Airport Pkwy, San Jose, CA 95110, USA;

Beneficiary Acct#: 501059612

ABA#: 12114 (the “TKOI Bank Account”)

14.3.2 Any payment made by the Borrower or VDA Group to the Lender will be done to the following bank account:

Bank: _Chase Bank Account #516328686

Routing #021000021 (Wire Transfers only)

(the “Lender Bank Account”).

Each Party may inform the other Parties on a different bank account opened in its name for paymants under this Agreement by giving at least five (5) business days’ notice.

14.4 Assignment

This Agreement shall inure to the benefit of and be binding upon the Parties, their respective successors and any permitted assignee or transferee of some or all of a party's rights or obligations under this Agreement. The Borrower shall not assign, novate or transfer all or any part of its rights or obligations hereunder to any other party. The Lender may freely assign its rights under this Agreement.

14.5 Governing law

This Agreement and all matters arising from or connected with it are governed by, and shall be construed in accordance with, Luxembourg law.

14.6 Luxembourg courts

The courts of Luxembourg-City have exclusive jurisdiction to settle any dispute (a “Dispute”) arising from or connected with this Agreement (including a Dispute regarding the existence, validity or termination of this Agreement) or the consequences of its nullity.

14.7 Language

The language which governs the interpretation of this Agreement is the English language.

14.8 Amendments

Save as otherwise provided herein, this Agreement may not be varied or otherwise modified except by an agreement in writing signed by both Parties.

14.9 Partial Invalidity

The illegality, invalidity or unenforceability to any extent of any provision of this Agreement under the law of any jurisdiction shall affect its legality, validity or enforceability in such jurisdiction to such extent only and shall not affect its legality, validity or enforceability under the law of any other jurisdiction, nor the legality, validity or enforceability of any other provision.

- 19 -

14.10 Costs

Each Party shall bear its own costs in respect of this Agreement.

[Signature page follows]

- 20 -

IN WITNESS WHEREOF this Agreement has been executed on the date first mentioned above in two original versions, one for each Party.

| For NOMADIX HOLDINGS LLC, as Lender | |

| /s/ | |

| Name: Ted HELVEY | |

| Title: Manager | |

| For VDA HOLDING S.A., as Borrower | |

| /s/ | |

| Name: Giorgio BIANCHI | |

| Title: Director (Administrateur) | |

| /s/ | |

| Name: Marco GOSTOLI | |

| Title: Director (Administrateur) | |

| For VDA GROUP S.P.A., as Guarantor | |

| /s/ | |

| Name: Piercarlo GRAMAGLIA | |

| Title: CEO (Presidente del Consiglio di Amministrazione) |

- 21 -

LIST OF APPENDICES

Appendix 1 – Drawdown Request

Appendix 2 – Share Pledge Agreement

Appendix 3 – VDA Group Share Pledge Agreement

Appendix 4 – Subordination Agreement

Appendix 5– Borrower Warranties and Representations

Appendix 6 – Financial Indebtedness at the date of this Agreement

Appendix 7 – Term Sheet

- 22 -

Appendix 1: Drawdown Request

VDA HOLDING S.A.

26, Boulevard Royal

L-2449 LUXEMBOURG

RCSL B239150,

To: NOMADIX HOLDINGS LLC

1209 Orange St., New Castle,

WILMINGTON, DE 19801, USA

Attention: Ted HELVEY

Date: [DATE]

VDA Holding S.A.

$5,000,000.00 (five million U.S. dollars) convertible loan agreement dated [DATE] between (1) NOMADIX HOLDINGS LLC as the Lender and (2) VDA Holding S.A. as the Borrower (the “Agreement”)

We refer to the Agreement. This is a Drawdown Request. Words and expressions defined in the Agreement have the same meaning in this Drawdown Request unless given a different meaning in this Drawdown Request.

We give you notice that we wish to draw down the following Loan on [DATE]:

Amount: U.S. dollars $5,000,000.00 (five million U.S. dollars)

Drawdown Date: DATE – not later than 20 January 2022

Account to be credited: By wire transfer directly to the Bank Account of Telkonet, Inc., 20800 SWENSON DRIVE STE 175 WAUKESHA, WI 53186, Beneficiary Acct#: 501059612, ABA#: 12114, with Heritage Bank of Commerce, 224 Airport Pkwy, San Jose, CA 95110, USA (the “TKOI Bank Account”).

Communication: Payment on behalf of VDA GROUP S.p.A. in exchange for title to 162,900,947 shares of Telkonet Common Stock, a Warrant for 105,380,666 additional shares of Telkonet Common Stock, the right to appoint 3 of 5 directors of Telkonet and other rights enumerated in the SPA.

We confirm that, on today’s date and the proposed Drawdown Date:

1 The representations and warranties are true and correct, and will be true and correct immediately after the proposed Loan.

2. No Event of Default or Potential Event of Default is continuing or would result from the proposed Loan.

- 23 -

This Drawdown Request is irrevocable.

For and on behalf of

VDA Holding S.A.`

| /s/ | /s/ | |

| Name: | Name: | |

| Title: | Title: |

- 24 -

Appendix 2: VDA HOLDING Share Pledge Agreement

- 25 -

Appendix 3: VDA Group Share Pledge Agreement

- 26 -

Appendix 4 – Subordination Agreement

- 27 -

Appendix 5 – Borrower Warranties and Representations

The Borrower makes the representations and warranties set out in this Appendix5 to the Lender on the date of this Agreement.

For the purpose of this Schedule 6, “Transaction Documents” shall mean this Agreement, the Security Documents and the Subordination Agreement, as well as any ancillary documents thereto.

1. Status

(a) It is a joint stock company (société anonyme), initially incorporated under Italian law, then migrated to Luxembourg and now validly existing under the laws of Luxembourg.

(b) It has the power to own its assets and carry on its business as it is being conducted.

2. Binding obligations

The obligations expressed to be assumed by it in the Transaction Documents are legal, valid, binding and enforceable obligations.

3. Non-conflict with other obligations

The entry into and performance by it of, and the transactions contemplated by, the Transaction Documents do not and will not conflict with:

(a) any law or regulation applicable to it;

(b) its constitutional documents; or

(c) any Material Agreement or instrument binding upon it or any of its assets or constitute a default or termination event (however described) under any such agreement or instrument, in each case in any material respect.

4. Power and authority

(a) It has the power to enter into, perform and deliver, and has taken all necessary action to authorise its entry into, performance and delivery of, the Transaction Documents to which it is or will be a party and the transactions contemplated by those Transaction Documents.

(b) No limit on its powers will be exceeded as a result of the borrowing, grant of security or giving of guarantees or indemnities contemplated by the Transaction Documents to which it is a party.

5. Validity and admissibility in evidence

(a) All authorisations required or desirable:

(i) to enable it lawfully to enter into, exercise its rights and comply with its obligations in the Transaction Documents to which it is a party; and

(ii) to make the Transaction Documents to which it is a party admissible in evidence in all relevant jurisdictions,

have been obtained or effected and are in full force and effect.

(b) All authorisations necessary for the conduct of the business, trade and ordinary activities of the Borrower have been obtained or effected and are in full force and effect if failure to obtain or effect those authorisations has or is reasonably likely to have a Material Adverse Effect.

- 28 -

6. Deduction of Tax

It is not required to make any deduction for or on account of Tax from any payment it may make under any Transaction Document to the Lender.

7. Taxes

(a) It has duly and punctually paid and discharged all taxes imposed upon it or its assets within the time period allowed without incurring interest or penalties save to the extent that (i) payment is being contested in good faith and it has maintained adequate reserves for the payment of such taxes or (ii) payment can be lawfully withheld and failure to pay those taxes is not reasonably likely to have a Material Adverse Effect and provided that the Borrower has taken all reasonable steps to ensure that such Taxes are paid and discharged as soon as reasonably practicable.

(b) It is not materially overdue in the filing of any tax returns.

(c) No claims or investigations are being, or are reasonably likely to be, made or conducted against it with respect to taxes.

(d) It is not treated for any tax purposes as resident in a country or jurisdiction other than Luxembourg and it does not have a branch, agency, permanent establishment or permanent representative in any other jurisdiction.

8. No Default

(a) No Event of Default and, as at the date of this Agreement and the Drawdown date, no default is continuing or is reasonably likely to result from the making of the Drawdown or the entry into, or the performance of, or any transaction contemplated by, any Transaction Document.

(b) No other event or circumstance is outstanding which constitutes (or, with the expiry of a grace period, the giving of notice, the making of any determination or any combination of any of the foregoing, would constitute) a default or a termination event (however described) under any other agreement or instrument which is binding on it or to which any of its assets are subject which has or is reasonably likely to have a Material Adverse Effect.

- 29 -

9. Information

(a) All information supplied in writing by it or on its behalf to the Lender in connection with the Transaction Documents was true and accurate in all material respects as at the date it was provided or as at any date at which it was stated to be given.

(b) Any financial projections contained in the information referred to in paragraph (a) above have been prepared as at their date on the basis of recent historical information and on the basis of reasonable assumptions.

(c) It has not omitted to supply any information which, if disclosed, would make the information referred to in paragraph (a) above untrue or misleading in any material respect.

(d) As at the Drawdown, nothing has occurred since the date of the information referred to in paragraph (a) above which, if disclosed, would make that information untrue or misleading in any material respect.

10. Financial statements

(a) Its annual financial statements were prepared in accordance with Luxembourg GAAP consistently applied.

(b) There has been no material adverse change in its business or financial condition (or the business or consolidated financial condition of its group) since the preparation and filing of the last annual financial statements.

(c) Its financial statements give a true and fair view of its financial condition.

(d) Its most recent interim financial statements prepared as at 18 October 2021:

(i) have been prepared in accordance with Luxembourg GAAP as applied to the annual financial statements; and

(ii) fairly present its financial condition as at the date of Drawdown.

(e) Since the date of the most recent financial statements delivered as at 18 October 2021 there has been no material adverse change in its business, assets or financial condition, or the business, assets or financial condition of its group.

11. Pari passu ranking

Its payment obligations under the Finance Documents rank at least pari passu with the claims of all its other unsecured and unsubordinated creditors, except for obligations mandatorily preferred by law applying generally.

12. No proceedings

(a) No litigation, arbitration or administrative proceedings or investigations of, or before, any court, arbitral body or agency which are reasonably likely to be adversely determined against it and, if so adversely determined, are reasonably likely to have a Material Adverse Effect have (to the best of its knowledge and belief (having made due and careful enquiry)) been started or threatened against it.

- 30 -

(b) No judgment or order of a court, arbitral body or agency which is reasonably likely to have a Material Adverse Effect has (to the best of its knowledge and belief (having made due and careful enquiry)) been made against it.

13. No other business

(a) The Borrower has not traded or carried on any business since the date of its incorporation other than the business described in its corporate object and related ancillary activities.

(c) As at the date of this Agreement the Borrower does not hold any direct Subsidiaries other than VDA Group.

(d) The Borrower:

(i) does not have, or has not had, any employees; and

(ii) has no obligation in respect of any retirement benefit or occupational pension scheme.

14. Centre of main interests and establishments

For the purposes of Regulation (EU) 2015/848 of 20 May 2015 on insolvency proceedings (recast) (the "Regulation"), its centre of main interest (as that term is used in Article 3(1) of the Regulation) is situated in Luxembourg and it has no "establishment" (as that term is used in Article 2(10) of the Regulation) in any other jurisdiction.

15. Ranking of Security

Subject to the perfection requirements, the security conferred by each Security Document constitutes a first ranking and priority security interest of the type described, over the assets referred to, in that Security Document and those assets are not subject to any prior or pari passu security interest.

16. Ownership

(a) The Borrower's entire issued share capital is legally and beneficially owned and controlled by its shareholders being METI HOLDING SARL and Mr Arturo Iossa FASANO.

(b) The shares in the capital of the Borrower are fully paid and are not subject to any option to purchase or similar rights.

(c) The constitutional documents of the Borrower do not and could not restrict or inhibit any transfer of the shares of the Borrower or on creation or enforcement of the security conferred by the Security Documents.

17. Financial Assistance

None of the proceeds of the Loan or other credit which is the subject matter of the Transaction Documents have been used or are being used, nor will they be used at any time in any way which would constitute “financial assistance” as referred to by Articles 430-19 and 430-21 of the amended law of 10 August 1915 on commercial companies (the “Law of 1915”) or which would result in the Transaction Documents or the transactions thereby contemplated (including without limitation the guarantees and indemnities thereby created) contravening the Law of 1915.

18. Loans to directors and connected persons

The Transaction Documents and the transactions contemplated by the Transaction Documents do not constitute loans, quasi-loans, guarantees, security or credit transactions entered into by the Borrower to or for the benefit of any of the directors of the Borrower or of the Borrowers shareholders (or any person connected to such persons).

- 31 -

19. VDA Group

The Warranties and Representations in this Appendix 5 will apply mutatis mutandis to VDA Group, with the premise that VDA Group:

| (i) | is a joint stock limited company (società per azioni) duly incorporated and existing under the laws of Italy; | |

| (ii) | has its registered office and corporate seat in Italy; | |

| (iii) | prepares its financial statements under Italian GAAP; | |

| (iv) | employs staff in Italy; | |

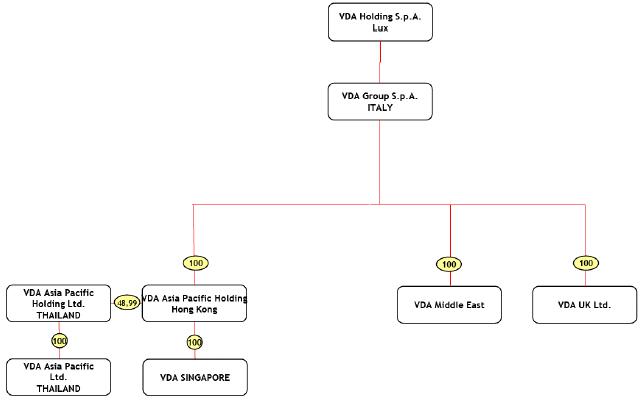

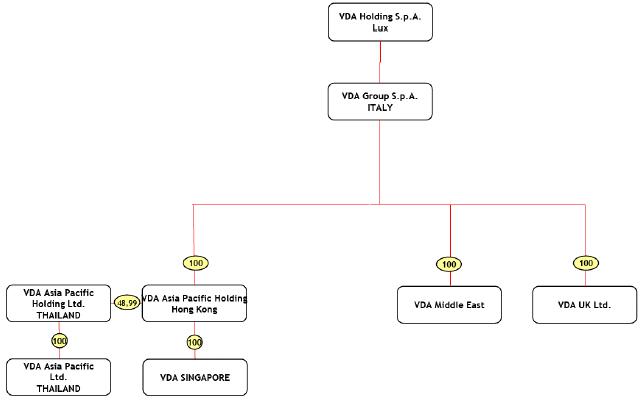

| (v) | has the direct and indirect subsidiaries as shown in the following graph (note: in the structure chart “VDA Holding S.p.A." in fact designates VDA Holding S.A.): |

- 32 -

Appendix 6 – Financial Indebtedness at the date of this Agreement

- 33 -

Appendix 7 – Term Sheet

- 34 -