|

Re:

|

Telkonet,

Inc.

File No. 1-31972

Form

10-K for Year Ended December 31, 2006

Form

10-Q for Quarter Ended March 31, 2007 and June 30,

2007

|

|

1.

|

We

will amend the Company’s 10-K for the year ended December 31, 2006, to

comply with the appropriate disclosures in the Comment

Letter.

|

|

2.

|

We

will amend the respective Forms 10-Q filed by the Company for the

period

ended March 31, 2007, and June 30, 2007, to comply with the appropriate

disclosures in the Comment Letter.

|

|

3.

|

We

will amend the Company’s 10-K for the year ended December 31, 2006, to

comply with the appropriate disclosures in the Comment

Letter.

|

|

4.

|

As

previously stated, we determine the allowance for doubtful accounts

by

examining the historical estimation of the account reserve as well

as

considering any outstanding invoice that is over 30 days past due

as of

the end of the reporting period. The customer accounts are reviewed

on a

case-by-case basis, and the allowance is estimated upon management’s

discretion after consideration of the above factors. We will

amend the respective Form 10-K for the year ended December 31, 2006

and

Form 10-Q for the periods ended March 31, 2007 and June 30, 2007.

The

allowance for doubtful accounts does not include receivables from

HLC.

|

|

5.

|

The

Company applied an after tax discount rate to determine the fair

value of

the intangible assets.

|

| 6. | The Company’s obligations under the vendor program agreement are, among others, to fulfill the support obligations associated with the acquired contracts. Our obligation to HLC is to support the customer through the remainder of the acquired contract. |

|

|

The

service obligation costs are accounted for “as incurred” on a monthly

basis. For example, the outsourced customer support vendor utilized

by the

Company is paid on a per call basis. The Company is not obligated

to

repair or replace equipment or provide software modification during

the

term. The current monthly service obligations are expensed to operations

to correspond with the monthly support

revenue.

|

|

|

The

Company believes it received consideration at fair value for the

support

and the equipment, respectively, under the Portfolio Purchase

Agreement. The Company allocated 30% of the remaining contract

value to the ISP and customer support element as a fair value to

fulfill

the support and ISP service for the remaining term. The Company considered

an allocation across the contracts reasonable as the individual contracts

were typically standard in pricing and services to

support. Additionally, the Company’s determination was based

upon its prior experience supporting 200 hotels and a market analysis

performed by the Company prior to the sale. Based upon the

foregoing, the Company believes the support services were fairly

valued.

|

|

•

|

an

allegation that the Company (or any third party acting on the Company’s

behalf) failed to satisfactorily perform its obligations arising

under the

customer’s contract, which failure to perform is not cured within 30 days

after receipt of written notice by the Company from HLC of such

failure;

|

|

•

|

termination

of the customer contract by the customer in accordance with its

terms;

|

|

•

|

HLC’s

de-installation and removal of equipment upon the expiration or

termination of the customer contract (but only in cases where the

customer

contract provides for the payment of such costs and expenses by

the

customer);

|

|

•

|

a

change of control of the customer that negatively affects such

customer’s

creditworthiness or ability to pay its debts as they become due

(but only

in cases where the customer contract expressly provides for termination

by

the customer upon the occurrence of a change of control);

or

|

|

•

|

an

allegation by the customer that a “force majeure” event has occurred (but

only in cases where the customer contract expressly provides for

termination upon the occurrence of a “force majeure”

event)

|

|

7.

|

Upon

further review of paragraph 24 of SFAS 95, the Company concurs that

the

proceeds attributable to the sale to HLC should be classified as

operating

activities. However, the Company considers such reclassification

as

immaterial to the consolidated cash flow statement because the $350,751

in

proceeds from net cash used in investing activities reclassified

to net

cash used in operating activity would amount to a 5% and 3% change,

respectively. To further clarify, the customer contracts and equipment

sold to HLC represented a final sale and the equipment was not leased

to

HLC prior to being sold.

|

|

8.

|

The

Portfolio Purchase Agreement and Vendor Program Agreement between

the

Company and HLC distinguished the equipment sale from the customer

support

service.

|

|

•

|

As

noted in response 6 above, the Company allocated 30% of the remaining

contract value to the ISP and customer support element as a fair

value to

fulfill the support and ISP service for the remaining term. The Company

considered an allocation across the contracts reasonable as the majority

of the contracts were standard in pricing and

services. Additionally, the Company’s determination was

based upon its past experience providing substantially similar support

services to over 200 hotel properties. Furthermore, the

Company believes the value of support services is comparable and

consistent with competitors offerings based upon a competitive analysis

prepared by the Company prior to the

sale.

|

|

•

|

The

Company also allocated the equipment component of the sale to HLC

across

the individual contracts since the majority of the contracts sold

to HLC

contained substantially similar pricing terms and involved

substantially similar equipment. The Company determined the

fair value of the equipment based upon comparable direct stand-alone

customer sales as well as its knowledge of the marketplace. The

Telkonet iWire system, upon installation, has the ability to provide

internet service to a hotel’s customer irrespective of the Company’s

support services. For example, a hotel customer can purchase the

Company’s

products and maintain customer support with Hotel technical staff.

Additionally, the Company began selling the Telkonet iWire system

components directly to independent value-added resellers without

support

services. On this basis, the Company believes that the

equipment was fairly valued and operable on a stand-alone

basis.

|

|

•

|

The

Company believes objective and reliable evidence was utilized in

determining fair value in our analysis of the customer

contracts. The Company sold over 200 contracts to HLC which

were substantially similar in terms, including pricing and services.

The

percentage allocation to each individual contract was considered

reasonable fair value as the Company analyzed the support element

and the

equipment element separately for the similar contracts sold to

HLC. Given

the Company’s experience in the industry and with the portfolio of

customers and the substantially similar terms of the contracts,

the

Company does not believe that a separate fair value analysis for

each

individual contract was

warranted.

|

|

Paragraph

#

|

EITF

00-21 Analysis

|

|

9

|

The

delivered equipment sold to HLC has component value for each

underlying customer on a standalone basis and the Company previous

sold

equipment without the customer support services. The Company

has objective and reliable evidence of the fair value of the future

ISP

and support services.

|

|

10

|

Not

applicable.

|

|

11

|

Arrangement

with HLC is fixed and determinable based upon the portfolio purchase

agreement and vendor program agreement.

|

|

12

|

The

Company evaluated the relative fair value of the equipment and support

individually based upon the standalone value of the equipment and

future

support services to be provided.

|

|

13

|

Not

applicable.

|

|

14

|

The

equipment sale was not contingent upon the delivery of additional

items or

performance conditions.

|

|

15

|

Not

applicable

|

|

16

|

The

Company’s vendor-specific objective evidence (VSOE) of fair value

consisted of (a) equipment sale as compared to internal comparable

pricing

on a standalone basis to customers (b) support services based upon

the

Company’s previous experience supporting 200 hotel properties and a

separate competitive analysis prepared by the Company prior to the

sale.

|

|

9.

|

As

of December 31, 2006 and March 31, 2007, the Company

performed the following analysis under paragraphs 7-32 of 00-19 to

determine whether equity classification was appropriate for the warrants

issued in connection with the senior convertible

debentures:

|

|

Paragraph

#

|

Analysis

as of December 31, 2006 and March 31, 2007

|

|

7

|

The

warrants issued in connection with the senior convertible debentures,

assumes settlement in fixed number of shares.

|

|

8

|

Since

the warrants are settled in a fixed number of its

common shares, the Registrant classified the

contracts as permanent equity as of December 31, 2006 and March 31,

2007

|

|

9

|

See

below responses.

|

|

10

|

The

Registrant reassessed the warrants outstanding at December 31,

2006 and March 31, 2007 and concluded no events occurred to

cause the warrants to be reclassified as a liability or temporary

equity

|

|

11

|

The

warrants do not contain such provisions.

|

|

12

|

Not

applicable.

|

|

13

|

See

below responses.

|

|

14

|

The

warrants may be settled with unregistered shares of common

stock.

|

|

15

|

Not

applicable

|

|

16

|

The

terms of the warrant agreements specify that a failure to maintain

effectiveness will result in liquidated damages of 1% per month through

the “Registration Period”. The Company is required to maintain

the effectiveness of the Registration Statement pursuant to Rule 415

at all times until the earlier of (i) the date as of which the

Investors may sell all of the Registrable Securities covered by such

Registration Statement without restriction pursuant to Rule 144(k)

(or any

successor thereto)promulgated under the 1933 Act or (ii) the date on

which the Investors shall have sold all of the Registrable Securities

coveredby such Registration Statement (the “Registration

Period”).

|

|

17

|

Not

applicable.

|

|

18

|

Not

applicable.

|

|

19

|

The

Company has sufficient authorized and unissued shares as of the most

recent balance sheet date to settle the delivery of the common shares

underlying the embedded options and all other

commitments

|

|

20

|

The

number of shares to be delivered in connection with the

warrants is fixed; there are sufficient authorized and unissued

shares of common stock available to settle the

obligations

|

|

21

|

See

response to paragraph 19.

|

|

22

|

Not

applicable.

|

|

23

|

Not

applicable.

|

|

24

|

Not

applicable.

|

|

25

|

Not

applicable- Superseded by FSP EITF 00-19-2

|

|

26

|

Not

applicable.

|

|

27

|

Not

applicable.

|

|

28

|

Not

applicable.

|

|

29

|

Not

applicable.

|

|

30

|

Not

applicable.

|

|

31

|

Not

applicable.

|

|

32

|

Contracts

do not require the posting of

collateral

|

|

10.

|

We

have reviewed our response to prior comment 11. We

are liable for liquidated damages in respect of shares of common

stock underlying warrants attached to the securities

purchased. The Registrant believes its accounting policy for

warrants issued in accordance with the private placements was reasonable

and complies with current accounting principles generally accepted

in the

US.

|

|

11.

|

The

Senior Convertible Debentures accrue interest at 8% per annum commencing

on the first anniversary of the original issue date of the debentures,

payable quarterly in cash or common stock, at the Company’s option, and

mature on April 30, 2010. The Company will amend and revise the disclosure

accordingly.

|

|

|

The

Company and noteholders are subject to a “Beneficial Ownership Limitation”

pursuant to which the number of shares of common stock of MSTI Holdings,

Inc. held by such noteholders immediately following conversion of

the

debenture shall not exceed 4.99% of all of the issued and outstanding

common stock of MSTI Holdings, Inc. The Company will amend and revise

the

disclosure accordingly.

|

|

12.

|

The

Company determined that the convertible debentures issued by MSTI

Holdings

represent conventional convertible debt since there are no provisions

that

provide for adjustment to the number of shares into which the notes

are

convertible and, therefore, the number of shares issuable upon conversion

is fixed as defined in EITF Issue 05-2, “The Meaning of ‘Conventional

Convertible Debt Instrument’ in Issue No.

00-19.”

|

|

13.

|

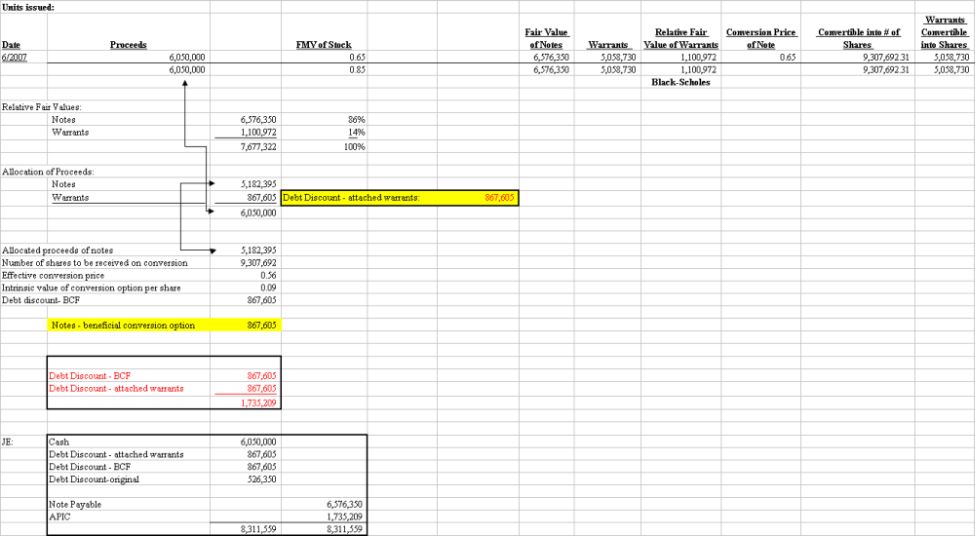

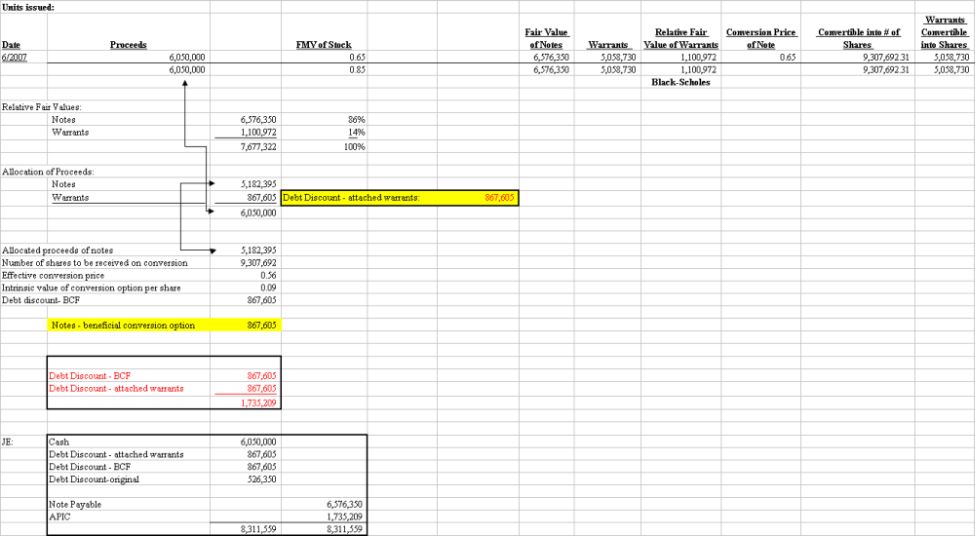

The

intrinsic value of the conversion feature was computed and a portion

of

the proceeds equal to the intrinsic value allocated to additional

paid-in

capital. The allocation resulted in a reduction of the initial carrying

amount of the debt. The intrinsic value of the conversion feature

is the

difference between the conversion price and the market price of the

underlying common stock, multiplied by the number of shares into

which the

security is convertible. Please see the calculation

attached as Exhibit A to this

correspondence.

|

| Sincerely,

TELKONET,

INC.

/s/

Richard J. Leimbach

Richard

J. Leimbach

Vice

President Finance

|